Optometry Equipment Market Research, 2031

The global optometry equipment market size was valued at $4,240.8 million in 2021, and is projected to reach $7,812.1 million by 2031, registering a CAGR of 6.3% from 2022 to 2031. Optometry is a branch of healthcare profession which is specialized in examining eyes and related structures for defects or abnormalities. Optometrists are health care professionals who typically provide comprehensive primary eye care. Optometry equipment is frequently used in hospitals and clinics for cornea, cataract, glaucoma, retina, and general examination purposes. Retinoscopes, visual field analyzers, specular microscopes, ophthalmoscopes, wavefront aberrometers, fundus cameras, autorefractors, keratometers, and other tools are examples of these optometry tools. In addition, optometry equipment is used for diagnosis and treating eye disorders like cataract, glaucoma and for general eye examination.

Historical Overview

The optometry equipment market size was analyzed qualitatively and quantitatively from 2021 to 2031. The optometry equipment market witnessed growth at a CAGR of around 6.3% during 2022-2031. Most of the growth during this period was from North America, owing to rise in the number of optometry equipment industry that manufacture optometry equipment, rise in disposable incomes as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global optometry equipment market is majorly driven by rise in the prevalence of eye disorder, increase in the number of geriatric population and rise in the prevalence of diabetes. Increase in prevalence of eye disorders, amongst the geriatric and youth population due to change in lifestyle, adoption of digital technology, and usage of screen for a longer duration is one of the major factors for the growth of the optometry equipment market. For instance, according to the data published by National Library of Medicine in July 2022, reported that around 285 million people have a visual impairment, of whom 19 million are children under the age of 14 years. As per the same source, myopia is the most common refractive problem worldwide. It is estimated that 22.9% of the world population is affected by myopia. In addition, myopia is projected to reach 49.8% by 2050.

Geriatric population is majorly susceptible to suffering from eye diseases such as cataract, glaucoma, age-related macular degeneration, dry eye, and refractive errors. For instance, in October 2022, according to World Health Organization (WHO), it was reported that approximately 2.2 billion population is suffering from vision disorders in the world. As per the same source approximately 88.4 million people are suffering from refractive errors, 94 million people are suffering from cataract, 8 million people are suffering from age-related macular degeneration and 7.7 million people are suffering from glaucoma.

Due to the process of aging, the nerves and the muscles surrounding the eyes become weak and susceptible to vision problems. For instance, according to the U.S. Census Bureau data published in December 2021, more than 56 million adults ages 65 i.e., 16.9% of the nation’s population and by 2050 is estimated to rise 85.7 million. Moreover, according to article published in JAMA Ophthalmology, in May 2022, states that 6.6 million people aged 60 years and older are projected to have vision impairment or blindness in 2050, up from 3.3 million in 2020. Thus, rise in prevalence eye disorders increases the demand of optometry equipment. Thus, this factor is anticipated to drive the growth of optometry equipment market.

On the other hand, major constraints limiting the market's growth include high prices and the use of recycled equipment. Due to ophthalmologists' preference for used equipment and the high cost of adopting optometry equipment, most ophthalmic device firms confront a significant obstacle. The cost of manpower, training, and the physical space needed for the machine are all considerable, as well as the cost of the machine itself. All these elements influence clinics and small diagnostic facilities' decisions to invest in such expensive equipment. Thus, this factor is anticipated to boost the growth of optometry equipment market.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global optometry equipment market. The COVID-19 pandemic has stressed healthcare systems globally. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for the patient diagnosed with COVID-19. Most of the non-emergency and minor procedures were canceled or postponed during pandemic. In addition, surgeons are more vulnerable for contracting and transmitting the coronavirus. Subsequently, this led to cancellation of many non-essential eye surgical procedures across the globe. Thus, these factors are anticipated to hinder the growth of the market during the pandemic. In addition, cancellation of health check-up camps for eye disorder in pandemic and decrease in number of consultations for vision disorders are anticipated to hamper the growth of market.

In addition, demand for optometry equipment decreased, owing to travel bans & quarantines, restriction of all indoor/outdoor events and massive slowing of supply chain of surgery systems/machines. For instance, according to an article published in National Library of Medicine in October 2022, states that there was largest decline in refractive surgeries accounting for 79% decrease in comparison to pre-pandemic levels. Thus, the outbreak of COVID-19 has negatively impacted the optometry equipment market growth.

Global Optometry Equipment Market Segmental Overview

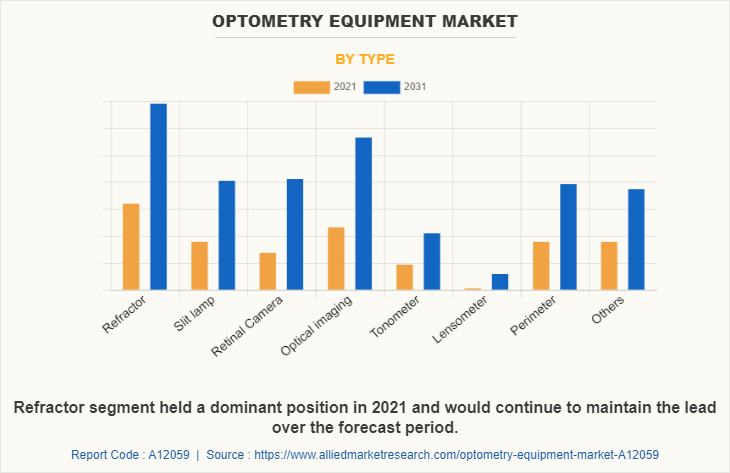

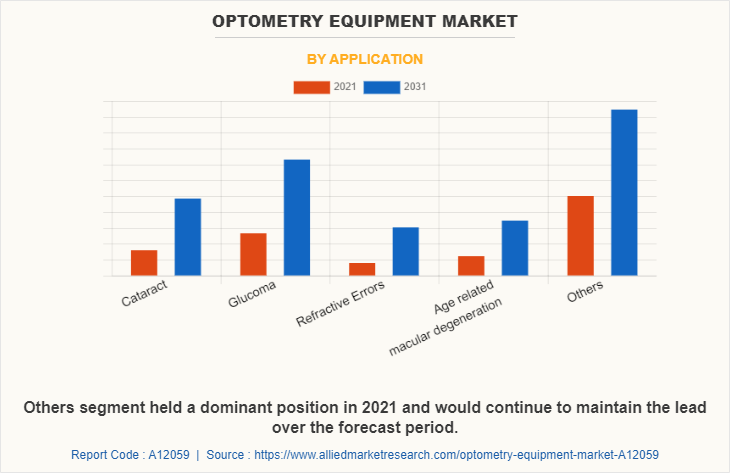

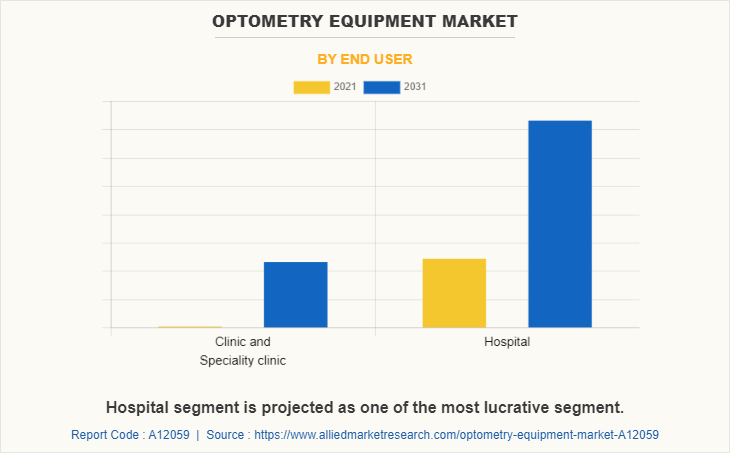

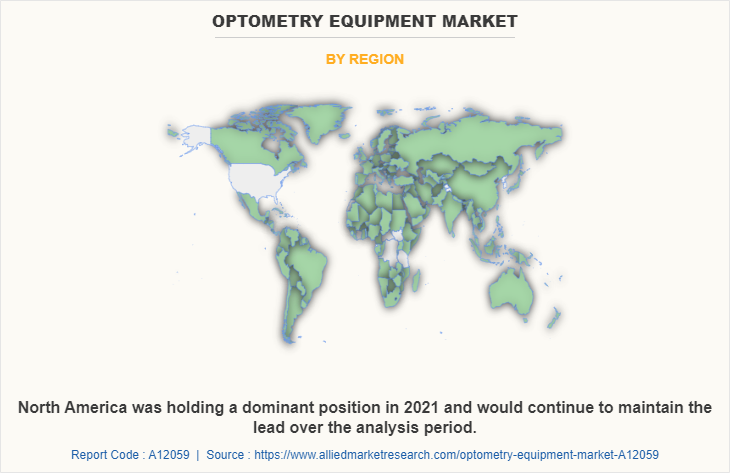

The optometry equipment market share is segmented into Type, Application, End User, and region. By type, the market is segmented into refractor, slit lamp, retinal camera, optical imaging, tonometer, lensometer, perimeter, and others. By application, the market is segmented into cataract, glaucoma, refractive errors, age related macular degeneration and others. By end user, the market is segmented into clinics & specialty clinics and hospitals. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

Based on type, the market is segmented into refractor, slit lamp, retinal camera, optical imaging, tonometer, lensometer, perimeter, and others. The retinal camera segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to increase in the usage of retinal camera for general examination of eye and diagnosis of cataract and rise in the number of new product launch for retinal camera.

By Application

Based on application, the market is classified into cataract, glaucoma, refractive errors, age related macular degeneration and others. The glaucoma segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in the prevalence of glaucoma and increase in the geriatric population.

By End User

Based on end user, the market is divided into clinics & specialty clinics and hospitals. The hospital segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to increase in the number of hospitals and rise in the expenditure by government to develop healthcare infrastructure.

By Region

The optometry equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America optometry equipment market is expected to grow during the forecast period owing to increase in the prevalence of vision impairment, cataract and glaucoma is anticipated to fuel the demand of optometry equipment which drives the growth of market in North America. For instance, according to Centers for Disease Control and Prevention (CDC), it was reported that, in 2020, approximately 30.1 million people in U.S. are suffering from cataract. In addition, in October 2022, according to the report shared by Bright Focus Foundation, there are 80 million people worldwide with glaucoma, and this number is expected to increase to over 111 million by 2040. In addition, according to Centers for Disease Control and Prevention (CDC), approximately 12 million people 40 years and over in the U.S. have vision impairment, including 1 million who are blind, 3 million who have vision impairment after correction, and 8 million who have vision impairment due to uncorrected refractive error. In addition, approximately 6.8% children younger than 18 years in the U.S. have diagnosed eye and vision disorders. 3% of children younger than 18 years are blind or visually impaired. Estimated number of people suffering from uncorrected vision impairment by 2050 is 8.96 million due to increase in the epidemic of diabetes and other chronic diseases.

Increase in the prevalence of diabetes cause rise in the risk of vision impairment, cataract and diabetic retinopathy and others. Thus, this factor contributes to drive the growth of optometry equipment market in North America. For instance, according to International Diabetes Federation (IDF), in 2021, 51 million population is living with diabetes in North America. 1 in 7 adults is diagnosed with diabetes. As per the same source, the number of adults with diabetes is expected to reach 57 million by 2030 and 63 million by 2045.

In addition, rise in the number of geriatric populations is attributes to drive the growth of market. As geriatric population is more susceptible to vision disorders such as glaucoma, cataract and vision impairment, this factor drives the market growth. For instance, according to the U.S. Census Bureau, more than 56 million adults ages 65 and over in U.S. By 2030, it is projected to reach 73.1 million older adults.

Optometry equipment market in Asia-Pacific is expected to grow during the forecast period owing to surge in prevalence of vision impairment and rising geriatric population drives the optometry equipment market. Moreover, rise in prevalence of vision impairment disorders is attributed to fuel the demand for optometry equipment and drives the optometry equipment market forecast period. For instance, in December 2020, according to review of myopia management, by the end of 2019, the prevalence of myopia in school-aged children and adolescents increased by 11.7% in the first half of 2020, with a15% increase in primary school students, 8.2% in junior high school students, and 3.8% in high school students.

In addition, rise in the number of key players that manufacture optometry equipment is Asia-Pacific are anticipated to drive the growth of market. For instance, Topcon Corporation, Canon Inc., Kowa American Co. are some key players attributes to drive the growth of optometry equipment market. In addition, rise in the number of product launch and increase in number of adoptions of key strategies such as acquisition by key players of optometry instruments are anticipated to drive the growth of market.

For instance, in June 2020, Topcon Healthcare, a leading provider of medical devices and software solutions for the global eye care community, announced the launch of MYAH instrument to the European region. MYAH is a comprehensive management tool for eyecare professionals interested in building, managing and growing myopia and dry eye services within their practice or research institution. In addition, in July 2020, Topcon Healthcare acquired Henson Perimeter Business, including the Henson 9000 and 7000 from Elektron Eye Technology (EET) of Cambridge, UK With Topcon’s growing emphasis on screening and early disease detection, the Henson product range will help the company enlarge its optometry equipment solutions business.

Competition Analysis

Competitive analysis and profiles of the major players in the optometry equipment market include Carl Zeiss AG., Essilor Luxottica, Topcon Corporation, NIDEK Co Ltd., Canon Inc., Heine Optotechnik, Revenio Group PLC., Oculus Inc., Halma PLc., and Kowa American Co. There are some important players in the market such as Topcon Corporation, NIDEK Co Ltd and others. Major players have adopted product launch, product expansion and acquisition as key developmental strategies to improve the product portfolio of the optometry equipment market.

Some examples of product launches in the optometry equipment market

In January 2021, Haag-Streit, a leading manufacturer and distributor of ophthalmic, optometry and orthoptic equipment, launched its Lenstar Myopia, a solution for the increasing demand for myopia management and patient education. The solution consists of HAAG-STREIT’s well-established Lenstar 900 optical biometer and the corresponding EyeSuite software called EyeSuite Myopia. The Lenstar 900 also performs keratometry to make accurate predictions about the onset and progression of myopia.

Acquisition in the optometry equipment market

in July 2020, Topcon Healthcare, a leading provider of medical devices and software solutions for the global eye care community, acquired Henson Perimeter Business, including the Henson 9000 and 7000 from Elektron Eye Technology (EET) of Cambridge, U.K. With Topcon’s growing emphasis on screening and early disease detection, the Henson product range will help the company enlarge its optometry equipment solutions business.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the optometry equipment market analysis from 2021 to 2031 to identify the prevailing optometry equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optometry equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global optometry equipment market trends, key players, market segments, application areas, and market growth strategies.

Optometry Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.8 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 439 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Kowa American Corporation, Essilor Luxottica, Heine Optotechnik, Halma plc, OCULUS, Inc., NIDEK Co Ltd, Canon Inc., Revenio Group PLC, Carl Zeiss AG, Topcon Corporation |

Analyst Review

Optometry equipment are devices used by healthcare professional knows as ophthalmologist for diagnosis of vision impairment disorders such as refractive errors, cataract, glaucoma, and others. Increase in the number of product launch and product approvals for optometry equipment and rise in the number of adoption of strategies such as collaboration, acquisition, and partnership by market players drives the market growth. For instance, in January 2021, Haag-Streit, a leading manufacturer and distributor of ophthalmic, optometry and orthoptic equipment, launched its Lenstar Myopia, a solution for the increasing demand for myopia management and patient education. The solution consists of HAAG-STREIT’s well-established Lenstar 900 optical biometer and the corresponding EyeSuite software called EyeSuite Myopia. The Lenstar 900 also performs keratometry to make accurate predictions about the onset and progression of myopia. In addition, in July 2020, Topcon Healthcare, a leading provider of medical devices and software solutions for the global eye care community, acquired Henson Perimeter Business, including the Henson 9000 and 7000 from Elektron Eye Technology (EET) of Cambridge, UK With Topcon’s growing emphasis on screening and early disease detection, the Henson product range will help the company enlarge its optometry equipment solutions business.

The top companies that hold the market share in optometry equipment market are Carl Zeiss AG., Essilor Luxottica, Topcon Corporation, NIDEK Co Ltd., Canon Inc., Heine Optotechnik, Revenio Group PLC., Oculus Inc., Halma PLc., and Kowa American Co.

Asia-Pacific is expected to register highest CAGR from 2022 to 2031, owing to rise in expenditure by government organization to develop the healthcare sector and increase in awareness among people regarding eye disease and its diagnosis.

The key trends in the optometry equipment market include rise in number of product launches and product approvals for optometry equipment and increase in cases as refractive errors, cataract glaucoma and age-related eye disorders.

The base year for the report is 2021.

Yes, optometry equipment market companies are profiled in the report

The total market value of optometry equipment market is $4,240.8 million in 2021.

The forecast period in the report is from 2022 to 2031

The market value of optometry equipment market in 2022 was $4,503.7 million

Loading Table Of Content...