Organic Spice Market Research, 2034

The global organic spice market size was valued at $1.6 billion in 2024, and is projected to reach $4.3 billion by 2034, growing at a CAGR of 10.6% from 2025 to 2034. Organic spices are naturally grown spices that are cultivated without the use of synthetic chemicals such as pesticides, herbicides, fertilizers, or genetically modified organisms (GMOs). These spices are produced through certified organic farming practices that emphasize environmental sustainability, soil health, and biodiversity. Organic cultivation typically involves natural methods like composting, crop rotation, biological pest control, and green manuring. Once harvested, organic spices are processed and packaged without artificial additives, preservatives, or irradiation, ensuring the retention of their natural aroma, flavor, and nutritional properties. Certified by regulatory bodies such as USDA Organic, EU Organic, or India Organic, these spices cater to health-conscious consumers and industries seeking cleaner, eco-friendly, and ethically sourced ingredients.

Key finding of the study

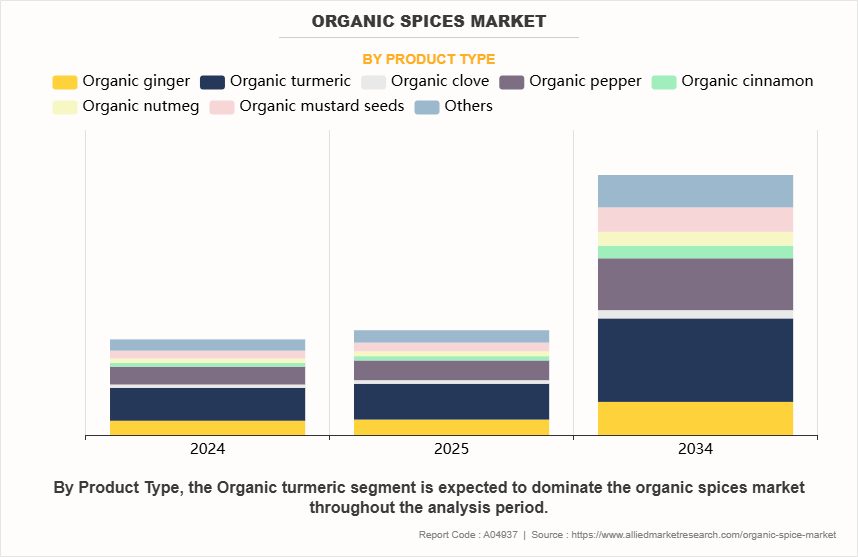

- On the basis of product type, the organic turmeric segment dominated the market in 2024 and is expected to retain its dominance throughout the forecast period.

- On the basis of form, the powder segment dominated the market in 2024 and is expected to retain its dominance throughout the forecast period.

- On the basis of distribution channel, the indirect segment dominated the organic spice market in 2024 and is expected to retain its dominance throughout the forecast period.

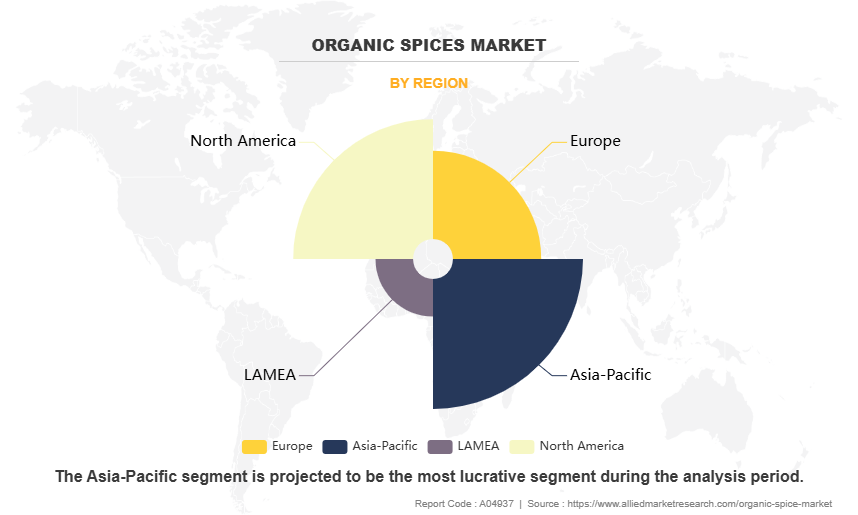

- By region, Asia-Pacific dominated the market in 2024 and is expected to retain its dominance throughout the forecast period.

Market Dynamics

The expansion of organic farming is significantly driving the growth of the market by ensuring a steady and increasing supply of pesticide-free, non-GMO, and chemical-free spice crops. Farmers are increasingly shifting from conventional to organic farming practices owing to rise in consumer awareness about the health benefits and environmental sustainability associated with organic products. Governments and private institutions across various regions are also supporting this transition through favorable policies, subsidies, training programs, and certification assistance. This expansion not only boosts the availability of raw materials required for organic spice production but also enhances traceability and quality assurance across the value chain. As a result, spice manufacturers can meet the growing demand for organic products in both domestic and international markets, particularly from health-conscious consumers, premium food brands, and the nutraceutical industry. Consequently, the rise in organic farming is acting as a fundamental pillar for the sustained development of the market.

The developments in e-commerce and retail distribution channels plays a pivotal role in driving the market growth by enhancing product accessibility, visibility, and convenience for consumers. The rise of online platforms such as Amazon, Walmart, and specialty organic retailers has made it easier for consumers to explore and purchase a wide variety of organic spice products from the comfort of their homes. These platforms also enable small and medium-sized organic spice producers to reach broader markets without the need for physical storefronts. Simultaneously, major supermarket chains and hypermarkets are expanding their organic product offerings, dedicating more shelf space to organic spices in response to increasing consumer demand for healthy and natural food options.

Value-added features such as product transparency, certification labels, and traceability information further influence purchasing decisions. Moreover, attractive packaging, competitive pricing, and regular promotional campaigns in both online and offline retail spaces are increasing consumer adoption. Collectively, the expansion of e-commerce and retail distribution is significantly amplifying market penetration and consumption of organic spices across diverse consumer segments globally.

Limited shelf life and storage challenges are significant restraints impacting the growth of the market. Unlike conventional spices, organic spices are produced without synthetic preservatives or irradiation, making them more susceptible to spoilage, moisture absorption, and loss of aroma and potency over time. These natural products require strict storage conditions such as controlled temperature, humidity, and protection from light and air to maintain their quality and shelf life. Inadequate storage infrastructure, particularly in developing regions, can lead to product degradation, contamination, and wastage, thereby affecting supply chain efficiency and increasing operational costs for producers and retailers. Additionally, the shorter shelf life poses logistical challenges in distribution and inventory management, making it difficult for retailers to stock large volumes without risking losses. These limitations also impact consumer perception, as products that lose flavor or freshness quickly may deter repeat purchases. As a result, the issue of limited shelf life and storage complexities poses a critical challenge to the scalability and profitability of the market.

The expansion of private labels and organic brands presents a significant growth opportunity for the market. Retailers are increasingly investing in their own private label organic spice lines to cater to the growing consumer demand for affordable yet high-quality organic products. These private labels often offer competitive pricing compared to established brands, making organic spices more accessible to a broader consumer base. Simultaneously, many organic-focused and health-conscious brands are expanding their product portfolios to include a diverse range of spice blends, single-origin spices, and value-added offerings such as ready-to-use organic seasonings. This brand diversification not only fosters innovation but also strengthens consumer trust through certifications and transparent sourcing practices. The growing emphasis on clean labeling, sustainability, and traceability further boosts the market appeal of these brands. Moreover, collaborations with e-commerce platforms and the strategic placement of private labels in supermarkets and health-oriented food stores enhance visibility and market penetration. As a result, the rise of private labels and specialized organic brands is fueling competition, expanding consumer choice, and creating robust opportunities for global organic spice market demand.

Segmentation Overview

The organic spice market segmentation is divided into product type, form, distribution channel, and region. On the basis of product type, the market is categorized into organic ginger, organic turmeric, organic clove, organic pepper, organic cinnamon, organic nutmeg, organic mustard seeds, and others. On the basis of form, the market is divided into powder, granular, extract, and raw. On the basis of the distribution channel, the market is divided into Direct and indirect. Region-wise, the organic spice market is analyzed across North America (U.S., Canada and Mexico), Europe (France, Germany, Italy, Spain, UK, and Rest of Europe), Asia-Pacific (China, ASEAN, India, Australia, New Zealand, and Rest of Asia-Pacific) and LAMEA (Brazil, South Africa, Middle East, Argentina and Rest of LAMEA)

By Product Type

By product type, the organic turmeric segment dominated the organic spice market in 2024 and is anticipated to maintain its dominance during the forecast period. This growth was driven by increasing consumer awareness of health benefits associated with turmeric, including its anti-inflammatory and antioxidant properties, as well as its widespread use in traditional medicine and functional foods. The rise in demand for clean-label and natural ingredients in both domestic and international markets further boost the consumption of organic turmeric.

By Form

By form, the powder segment dominated the organic spice market in 2024 and is anticipated to maintain its dominance during the organic spice market forecast period. This dominance was primarily due to the convenience, longer shelf life, and ease of use associated with powdered spices in both household and commercial kitchens. Powdered organic spices are widely preferred for their ability to blend seamlessly into recipes, ensuring consistent flavor and aroma.

By Distribution Channel

By distribution channel, the indirect segment dominated the organic spice market in 2024 and is anticipated to maintain its dominance during the forecast period. The growing popularity of organic food trends, increased availability of organic spices through supermarkets, specialty stores, and online platforms, and rise in disposable incomes contribute to this dominance. Additionally, clear product labeling, certifications, and consumer trust in organic brands further boosted sales within the indirect segment, making it the leading distribution channel for organic spices during the year.

By Region

By region, Asia-Pacific dominated the organic spices market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to its rich agricultural heritage, favorable climatic conditions, and extensive cultivation of a wide variety of spices. Countries like India, Sri Lanka, and Vietnam played a significant role, supported by strong domestic demand and a growing export base. The increasing adoption of organic farming practices, government initiatives promoting sustainable agriculture, and rising consumer awareness about health and wellness further fueled market growth in the region.

Competition Overview

Players operating in the market have adopted various developmental strategies to expand their organic spice market share, increase profitability, and remain competitive in the market. The key players profiled in the organic spice industry report include Ispice Foods, SunOpta Inc., AKO GmbH, Husarich GmbH, Organic Spices Inc., Pacific Spice Company Inc., Uk Blending Limited, Suminter India Organics, Ramon Sabater S.A.U, and Watkins Incorporated

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the organic spice market analysis from 2024 to 2034 to identify the prevailing organic spice market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the organic spices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global organic spice market trends, key players, market segments, application areas, and organic spice market growth strategies.

Organic Spices Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 4.3 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 286 |

| By Form |

|

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Ramon Sabater S.A.U, AKO GmbH, Husarich GmbH, Organic Spices Inc., SunOpta Inc., Watkins Incorporated, Suminter India Organics, Uk Blending Limited, Pacific Spice Company Inc., ispice foods |

Analyst Review

As per the CXOs, the organic spices market is one of the most potential categories of the larger organic food business, citing increased consumer knowledge, evolving dietary habits, and sustainability-driven preferences as significant drivers of present and future growth. According to agricultural scientists, food industry specialists, and ethical sourcing activists, the desire for organic spices is no longer unique, but rather part of a wider clean-label trend in which people actively seek accountability, purity, and traceability in every product they eat. These experts point out that today's consumers are looking for more than simply flavor; they want wellness, environmental sustainability, and ethical agricultural techniques.

Culinary professionals and food entrepreneurs have seen that organic spices have expanded beyond health food aisles and are now available in conventional supermarkets, gourmet kitchens, and nutritional formulations. Looking ahead, opinion leaders anticipate strong industry growth driven by advances in manufacturing, certification, and direct-to-consumer channels. They highlight the rising importance of digital technologies like blockchain traceability, QR code-enabled provenance, and AI-powered e-commerce influencing purchase decisions and fostering trust. Furthermore, experts anticipate that the growing popularity of plant-based diets, natural medicines, and ethnic cuisines will broaden demand, allowing lesser-known organic spices to attract worldwide notice.

The organic spice market registered a CAGR of 10.6% from 2024 to 2034.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the organic spice market report is from 2025 to 2034.

The top companies that hold the market share in the organic spice market Ispice Foods, SunOpta Inc., AKO GmbH, Husarich GmbH, Organic Spices Inc., Pacific Spice Company Inc. and others.

The organic spice market was valued at $1,567.2 million in 2024 and is estimated to reach $4,262.4 million by 2034, exhibiting a CAGR of 10.6% from 2025 to 2034.

The organic spice market report has 3 segments. The segments are product type, form, and distribution channel.

The emerging regions in the organic spice market are likely to grow at a CAGR of more than 11.0% from 2025 to 2034.

Asia-Pacific will dominate the organic spice market by the end of 2034.

Loading Table Of Content...

Loading Research Methodology...