Table Of Contents

Lalit Janardhan Katare

Koyel Ghosh

Automotive and Transportation: AMR’s Review of the Top 5 Markets in the Domain in Q2 2025

In the last few decades, the growing integration of advanced electronic systems in modern automobiles has transformed the automotive and transportation sector. Leading car manufacturing companies have started investing in cutting-edge technologies to enhance the safety of their vehicles and offer comfort to the driver and passengers. Additionally, R&D projects initiated by major research institutes and engineering universities in autonomous vehicles have opened new avenues for growth in the industry. The role of AI, machine learning, and neural networks has played a major role in creating new systems necessary for powering self-driving cars.

At the same time, rising emphasis on environmental sustainability has led to a transition toward electric and hybrid vehicles. Multinational private companies have started realigning their operations as per the evolving dynamics of the sector. Additionally, governments across the globe launched various schemes and initiatives that promote the use of sustainable modes of public transport, thereby creating new investment opportunities in the domain. Along with this, some markets in the automotive and transportation domain significantly boosted the revenue share of the domain in the second quarter of 2025. This newsletter, using AMR’s in-house ‘Title Matrix Tool’, summarizes the factors that are likely to impact the growth of the landscape in the coming period.

Automotive Sun Visor Market

The growth of the automotive sun visor market is attributed to increasing focus on technological advancements in automotive design and manufacturing. Moreover, surge in demand for vehicles equipped with smart features and safety measures is predicted to create favorable conditions for the growth of the landscape. The market accounted for $7 billion in 2023 and is anticipated to reach a sum of $11.5 billion by 2033, citing a CAGR of 5.3% during 2024-2033. Increasing consumer focus on driving comfort is expected to help the market flourish in the coming period.

The AMR report provides a detailed analysis of the various administrative, demographic, political, legal, socioeconomic, and cultural factors impacting the industry in various regions across the globe. The Asia-Pacific segment held a significant revenue share and is predicted to dominate the market in the coming period. A growing number of automobile sales in countries like China and India have played a major role in the expansion of the sector.

Car Security Systems Market

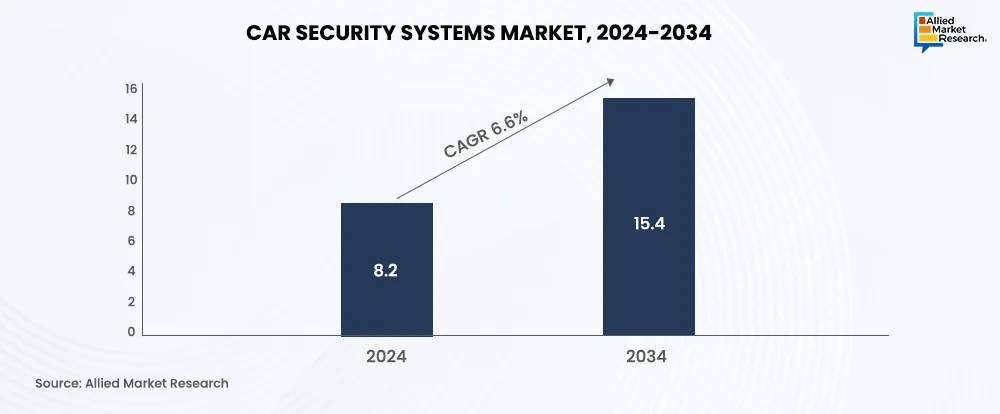

The car security systems market held a revenue share of $8.2 billion in 2024 and is predicted to reach $15.4 billion by 2034, citing a CAGR of 6.6% during 2025-2034. In the last few years, several developed and developing countries have passed laws making it mandatory for automobile companies to install robust security systems in vehicles to reduce vehicle theft and enhance overall road safety. Growing use of GPS navigation systems, biometric authentication, and other alarm systems has further surged the market share of the car security systems industry.

The AMR report also highlights the various segments of the industry based on type, vehicle type, and sales channel. By type, the immobilizer segment accounted for the largest share in the industry and is expected to witness significant growth in the coming period. The tamper-proof features offered by immobilizers have made them essential components in modern vehicle security solutions, thus opening new avenues for the growth of the sector.

Suspension Control Unit Market

Suspension control units are specialized automotive components that regulate the suspension systems in a vehicle to provide a smooth and comfortable ride to the driver and passengers. The suspension control unit market accounted for $16.7 billion in 2023 and is predicted to surge at a CAGR of 6.9% from 2024 to 2033, thus gathering a sum of $31.4 billion by 2033. Increasing integration of SCUs in luxury sedans, high-performance SUVs, and sports cars has impacted the market positively in the last few years. Additionally, rising adoption of air and electronic suspension systems is anticipated to drive industry growth in the years to come.

The AMR report covers the performance of the landscape in various countries of North America, LAMEA, Europe, and Asia-Pacific. The North America region attained the highest revenue share in 2023 and is predicted to capitalize on the lucrative opportunities in the near future. Rising demand for autonomous and electric vehicles has helped the industry flourish in recent times. Moreover, increasing sales of SUVs and commercial vehicles augmented the growth rate of the sector in Q2 2025.

Automotive RADAR Market

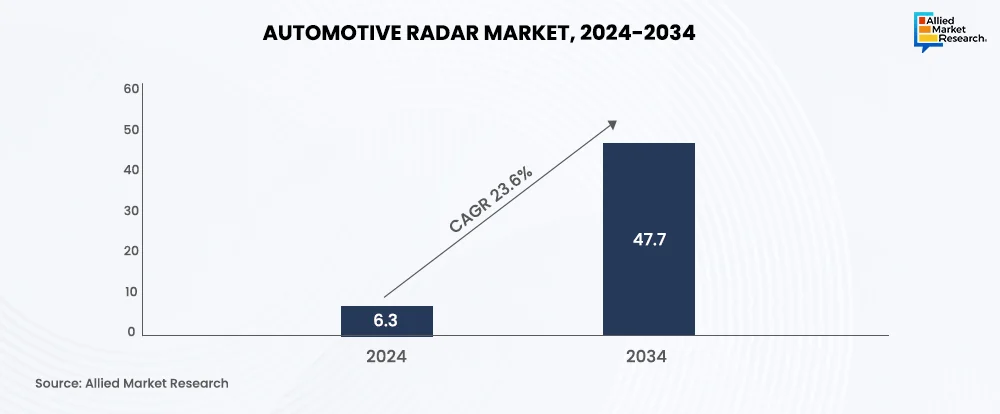

The automotive RADAR market is anticipated to garner a sum of $47.7 billion by 2034. The industry was valued at $6.3 billion in 2024 and is expected to rise at a CAGR of 23.6% during 2024-2034. Automotive RADAR systems have become an essential part of Advanced Driver Assistance Systems (ADAS), including collision avoidance, autonomous emergency braking, adaptive cruise control, and blind spot detection. A surge in demand for automatic parking assistance solutions has also played a major role in influencing the growth of the landscape. Moreover, laws passed in various countries have made it compulsory for automakers to install lane departure systems in their vehicles, thus expanding the scope of the market.

The AMR report classifies the industry into various segments based on application, frequency, and range. By application, the adaptive cruise control segment accounted for the largest revenue share in recent times and is expected to experience rapid growth in the years to come. The advent of semi-autonomous driving features in modern vehicles is anticipated to accelerate sectoral growth across the globe. Moreover, increasing preference for driver assistance systems has opened new avenues in the landscape.

Road Transport Logistics Market

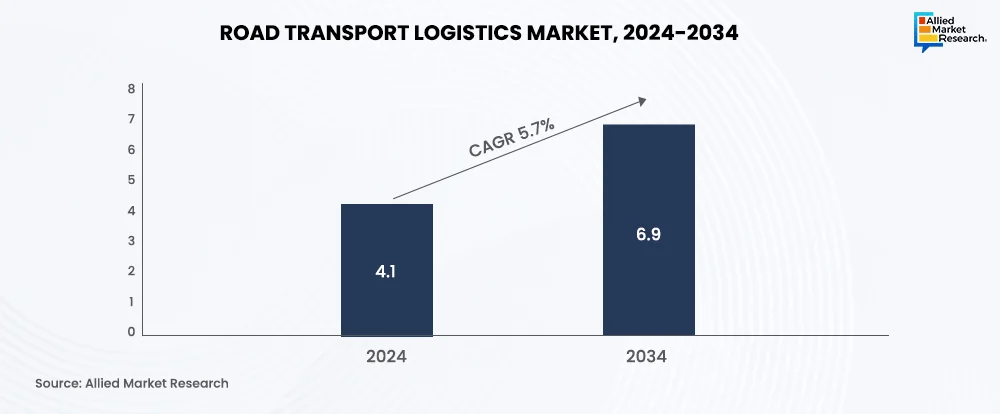

In the post-pandemic period, almost all countries around the world have invested heavily in the logistics sector to establish resilient supply chains and boost their trade competitiveness. Private companies, too, have adopted modern road transport mechanisms to strengthen their position in the industry. These factors have primarily contributed to the growth of the road transport logistics market. The industry, which accounted for $4.1 trillion in 2024, is predicted to garner $6.9 trillion by 2034, citing a CAGR of 5.7% during 2025-2034. The expansion of the e-commerce sector created numerous profitable opportunities for the sector in Q2 2025.

The AMR report provides a comprehensive segmental analysis of the industry based on vehicle type, end user, destination, and service type. By type, the light commercial vehicles segment is estimated to be the most promising and is projected to grow at a rapid pace in the near future. The flexibility and cost-efficiency offered by these vehicles in urban transport are expected to help the market flourish.

Summing up

The automotive and transportation domain has experienced massive growth in Q2 2025 and is predicted to generate significant gains in the next few years. Technological advancements and rising demand for robust security systems have revolutionized the industry. Additionally, the shift toward electric mobility and surge in investments in the logistics sector are anticipated to maximize the revenue share of the landscape.

For more insights into the latest trends and advancements in the automotive and transportation domain holistically, contact our experts.