Small Personal Loans Market Research, 2032

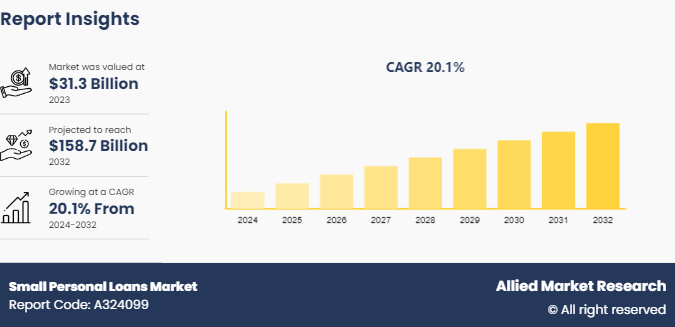

The global small personal loans market was valued at $31.3 billion in 2023, and is projected to reach $158.7 billion by 2032, growing at a CAGR of 20.1% from 2024 to 2032. The small personal loans market has grown steadily due to rising consumer demand for quick, unsecured credit solutions, particularly among individuals with limited access to traditional financial services. Fintech advancements and digital lending platforms have further fueled this growth by offering faster approvals and more accessible loan options.

Market Introduction and Definition

The small personal loan market refers to the financial sector offering unsecured loans of relatively modest amounts, typically ranging from a few hundred to several thousand dollars. These loans are designed to meet immediate personal financial needs without requiring collateral, making them accessible to a broad range of borrowers. Common uses include covering unexpected expenses, consolidating debts, or financing smaller purchases. Interest rates vary based on factors like creditworthiness and lender policies, with repayment terms generally shorter than those for larger loans. Lenders in this market include traditional banks, credit unions, online lenders, and peer-to-peer platforms, each offering different terms and eligibility criteria to cater to diverse borrower profiles.

Key Takeaways

The small personal loans market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected small personal loans market forecast period 2023-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major small personal loans market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights for Short-term personal loans

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global small personal loans markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives and small personal loans market outlook.

Key Market Dynamics

Small personal loans are driven by several factors that cater to the financial needs of individuals seeking immediate funds without the requirement of collateral. These loans offer a quick application and approval process, often providing funds within a short timeframe. This accessibility appeals to borrowers facing urgent financial situations such as medical emergencies or unexpected home repairs. Also, borrowers can utilize these loans for various purposes including consolidating debt, covering education expenses, or making essential purchases. This flexibility makes a versatile financial tool for managing diverse personal financial needs which drives the market.

However, due to the unsecured nature of these loans and the perceived risk to lenders, interest rates tend to be higher than those for secured loans. This can increase the overall cost of borrowing and make it challenging for some borrowers to repay the loan promptly, which hamper the market. Additionally, while beneficial for immediate needs, the maximum loan amount available may not suffice for larger financial obligations, potentially requiring borrowers to seek additional funding sources. Furthermore, the small personal loan market presents opportunities for both borrowers and lenders. For borrowers, these loans provide a means to address urgent financial needs without lengthy approval processes or collateral small personal loan requirements. They also offer an opportunity to build or improve credit history through responsible borrowing and timely repayment. For lenders, Risk Management and Technology Advancements: Advancements in technology allow for more efficient credit scoring, small personal loan transactions and risk assessment, potentially expanding the market reach and improving lending decisions. Additionally, Market Expansion: Growing demand for flexible financing options among consumers presents an opportunity for lenders to innovate and tailor products to meet specific borrower needs, potentially expanding their customer base and enhancing profitability in the competitive financial services landscape and increases the demand for small personal loan.

Demographic Insights

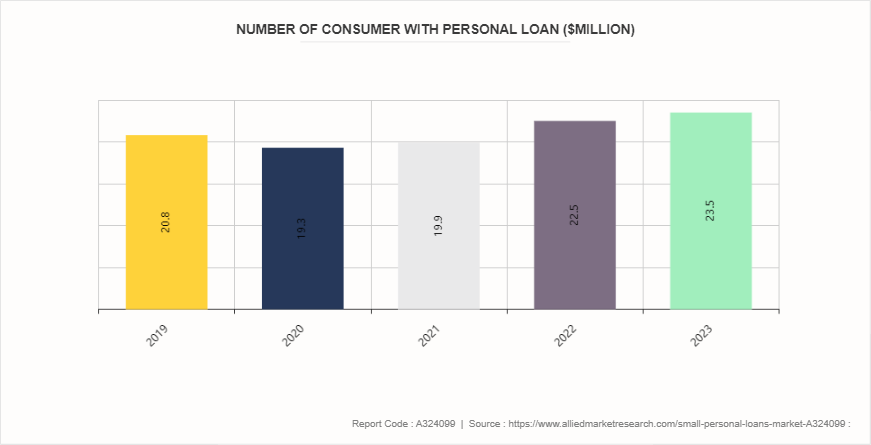

According to LendingTree's data as of the fourth quarter of 2023, the number of Americans holding personal loans has risen to 23.5 million, marking an increase from 22.5 million in the same period of 2022. The count of individuals with these loans had declined during the pandemic, dropping from a peak of 20.8 million at the end of 2019 to 18.7 million by the second quarter of 2021. Subsequently, there was a consistent upward trend, with six consecutive quarterly increases. However, there was a minor decrease from 22.5 million in the fourth quarter of 2022 to 22.4 million in the first quarter of 2023, after which the number has seen continuous growth in each subsequent quarter.

Market Segmentation

The small personal loans market is segmented into type, age, distribution channel, and region. On the basis of type, the small personal loans market is segregated into, P2P marketplace lending and balance sheet lending. On the basis of age, the market is segregated into, less than 30 years, 30-50 years and more than 50 years. On the basis of distribution channel, the market is segregated into, banks, credit unitions, online lenders and peer-to-peer lending. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The adoption of small personal loans or microloans varies across different countries, influenced by factors such as smart financial infrastructure, industry needs, regulatory frameworks, and investment in research and development and also impact the small personal loan suppliers. Developed countries like the U.S., Germany, Japan, and South Korea have been at the forefront of small personal loans adoption. These countries possess advanced financial capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of private loan solutions. In emerging economies such as China, India, Brazil, and Russia, there is a growing interest in small personal loans fueled by rapid change in education system, and government initiatives to promote digitalization and innovation in small personal loans market.

In October 2023, Government of Canada introduced new measures to ensure Canadians are treated fairly by their banks. These measures include protecting Canadians from rising mortgage payments, enhancing low-cost banking options, lowering non-sufficient fund (NSF) fees, and ensuring Canadians have an impartial advocate when they have complaints with their bank.

In September 2023, the U.S. Department of Education introduced more than 4 million student loan borrowers are enrolled in the Biden-Harris Administration's new Saving on A Valuable Education (SAVE) income-driven repayment (IDR) plan, including those who were transitioned from the previous Revised-Pay-As-You-Earn (REPAYE) plan.

In February 2024, U.S. Bank expands client access to personal loans. The bank offers a wider range of small personal loan services to clients the financial products they need, expanding access to credit and delivering more financial opportunity to more people.

In March 2024, Japan's Ministry of Education is expanding the scope of its financial aid provisions for non-Japanese students' university education. The Ministry offers scholarships, loans, and tuition reductions or exemptions through the Japan student services organization.

In March 2023, ArcelorMittal has entered into a $5 billion loan agreement with a consortium of Japanese banks to finance the company's expansion of small personal loan plans in India.

Industry Trends

The increasing adoption of online platforms and fintech solutions for small personal loans has transformed how borrowers access and manage their financial needs. This trend has accelerated notably over the past decade, driven by technological advancements and changing consumer preferences for convenience and efficiency. For instance, in May 2024 SoFi Technologies, Inc., a member-centric, one-stop shop for digital financial services that helps members borrow, save, spend, invest and protect their money, announced the Q1 2024 placement of a $350 million personal loan securitization exclusively with funds and accounts managed by PGIM Fixed Income, a Prudential Financial company.

Stricter regulations affecting loan terms, interest rates, and borrower eligibility criteria have become increasingly prevalent in the financial industry. These regulations are typically implemented by governmental bodies or regulatory agencies to protect consumers, ensure financial stability, and mitigate risks within the lending sector. For instance, in April 2024, Government of Canada launched the $5 billion Indigenous Loan Guarantee Program, to unlock access to capital for Indigenous communities, create economic opportunities, and ensure indigenous peoples share.

The growth of non-bank lenders and peer-to-peer (P2P) lending platforms offering competitive rates and flexible terms has reshaped the lending landscape in recent years, providing alternative financing options beyond traditional banks. For instance, in July 2023 LendingClub, another prominent P2P lending platform, continues to expand its offerings to include personal loans with competitive rates and streamlined application processes. Borrowers can apply for loans online, receive multiple offers, and choose terms that suit their financial needs, all while benefiting from potentially lower interest rates compared to traditional bank loans in small personal loans industry.

Competitive Landscape

The major players operating in the small personal loans industry include American Express, Avant, LLC, Barclays PLC, DBS Bank Ltd, Goldman Sachs, LendingClub Bank, Prosper Funding LLC, Social Finance, Inc., Truist Financial Corporation, and Wells Fargo.

Recent Key Strategies and Developments

In March 2023, Axis Bank partnered with Shriram Housing Finance Limited (SHFL) . Through this partnership, both the lenders will offer secured MSME (Micro, Small and Medium Enterprises) loans and home loans to the middle and low-income segment borrowers based in rural and semi-urban regions.

In June 2023, Thoughtworks with Amazon Web Services. This approach to rapid delivery can put an end to multi-year big budget efforts to launch a new product, and sets the scene for rapid product innovation and faster time to value.

In March 2022, BigPay launched its fully digital loans as part of the wider suite of financial services offerings. There has been an overwhelming demand for the personal loans product and it will be rolled out to more users over the coming weeks. BigPay Later Personal Loans is currently available to selected users and will be progressively rolled out to more and more people.

Key Sources Referred

Finaid

Lowa Student Loan

MEFA

OEDB

The Institute for College Access & Success

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the small personal loans market analysis from 2024 to 2032 to identify the prevailing small personal loans market opportunity.

The small personal loans market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the small personal loans market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global small personal loans market size.

Small personal loans market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and small personal loans market share.

The report includes the analysis of the regional as well as global small personal loans market trends, key players, market segments, application areas, and small personal loans market growth strategies.

Small Personal Loans Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 158.7 Billion |

| Growth Rate | CAGR of 20.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 232 |

| By Type |

|

| By Age |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Social Finance, Inc., DBS Bank Ltd, Barclays PLC, Wells Fargo, LendingClub Bank, American Express, Goldman Sachs, Prosper Funding LLC, Avant, LLC, Truist Financial Corporation |

The small personal loans market was valued at $31.3 billion in 2023 and is estimated to reach $158.7 billion by 2032, exhibiting a CAGR of 20.1% from 2024 to 2032.

Flexibility in load amounts and terms and increase in technological enhancements are the upcoming trends of Small Personal Loans Market in the globe.

Changes in demographic shift is the leading application of Small Personal Loans Market.

North America is the largest regional market for Small Personal Loans.

American Express, Avant, LLC, Barclays PLC, DBS Bank Ltd, Goldman Sachs, LendingClub Bank, Prosper Funding LLC, Social Finance, Inc., Truist Financial Corporation, and Wells Fargo are the top companies to hold the market share in Small Personal Loans.

Loading Table Of Content...