Software Defined Vehicle Market Research, 2034

The global software defined vehicle market size was valued at USD 258.9 billion in 2024, and is projected to reach USD 1902.9 billion by 2034, growing at a CAGR of 22.6% from 2025 to 2034.

Report Key Highlighters:

- The software defined vehicle industry study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The software defined vehicle market share is highly fragmented, into several players including Aptiv PLC, Tesla, Inc., Continental AG, NVIDIA Corporation, Robert Bosch GmbH, Li Auto Inc., Rivian Automotive, Inc., Volkswagen AG, General Motors Company, and Qualcomm Incorporated. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A software defined vehicle (SDV) is a vehicle that relies primarily on software to manage its operations, introduce new features, and enhance functionality. This concept marks a significant evolution in the automotive industry, serving as the foundation for advancements like self-driving and connected cars. SDVs represent a transformation from traditional electromechanical vehicles to intelligent, upgradable mobile electronic systems. The benefits of SDVs include enhanced safety through features such as anti-collision systems and driver assistance, improved comfort with integrated infotainment systems offering connected services such as music and video streaming, and deeper insights into vehicle performance via telematics and diagnostics, enabling effective preventative maintenance. Furthermore, SDVs empower automotive manufacturers to introduce new features and functionalities seamlessly through over-the-air updates, solidifying their role as a critical component of the industry's future.

Factors such as increase in adoption of advanced connectivity solutions such as AI and ML in vehicles, rise in demand for autonomous and connected vehicles, and the ongoing shift toward electrification are expected to drive the global software defined vehicle market growth during the forecast period. However, high initial development costs and cybersecurity concerns are anticipated to hamper the growth of the market during the forecast period. Moreover, the growth in over-the-air (OTA) updates and the emergence of new business models are expected to offer lucrative opportunities for the market in the future.

In, recent years advanced driver assistance systems (ADAS) have emerged as a critical focus in the automotive industry, driven by growing consumer demand for safety, convenience, and automation. ADAS includes features like adaptive cruise control, automatic emergency braking, lane departure warnings, and parking assistance, which are designed to enhance the driving experience while minimizing the risk of accidents. Governments worldwide are enforcing stringent safety regulations, compelling automakers to integrate ADAS into their vehicles to comply with standards such as Euro NCAP, NHTSA, and others. Moreover, automobile companies are focusing on the development of SDVs integrated with ADAS. For instance, May 2023, Tata Technologies, a global provider of engineering and product development digital services, signed a Memorandum of Understanding (MoU) with TiHAN IIT Hyderabad to collaborate on advancements in SoftwareDefined Vehicles (SDVs) and Advanced Driver Assistance Systems (ADAS). As automotive companies increasingly focus on developing SDVs integrated with autonomous technologies, they face challenges related to reducing technology incubation time and development costs. This partnership aims to create innovative solutions and accelerators to address these challenges, enabling the development of SDVs equipped with the latest technologies while optimizing efficiency and cost-effectiveness. In addition, increasing urbanization and the challenges of traffic congestion have amplified the demand for smart vehicle technologies, where ADAS plays a vital role. Technological advancements in sensors, cameras, LiDAR, and radar have improved the precision and functionality of these systems, making them more reliable and cost-effective. With the push toward autonomous vehicles, ADAS technologies serve as the foundation for higher levels of automation, further driving their adoption across both passenger and commercial vehicle segments. As awareness grows and regulatory frameworks tighten, the demand for ADAS is expected to be a significant driver of market growth.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On August 2024, Aptiv invested more than $45 million in engineering and facilities, as well, for the expansion of production of its intelligent manufacturing plant in Chennai, India to provide automotive manufacturers with software-defined cockpit solutions. In India, Aptiv offers a full suite of connected solutions to accelerate the transformation towards software-defined vehicles.

- On May, 2024 Continental AG collaborated with Qualcomm Technologies, Inc. to implement a cross-domain High-Performance Computer (HPC) in a car. The implementation was leveraged by the Snapdragon Ride Flex System-on-Chip (SoC) with pre-integrated Snapdragon Ride Vision perception stack from Qualcomm Technologies, Inc.

- On April 2024, Continental AG developed & introduced Zone Control Units(ZCUs) for European and Asian car manufacturers. Zone control units form the middle tier of the server-based electrical and electronic (E/E) architecture in software-defined vehicles. By introducing this technology, company received multiple customer orders for zone control units from car manufacturers worldwide.

- On December 2023, Continental AG collaborated with Synopsysto accelerate the development and validation of software features and applications for the Software-Defined Vehicle (SDV). This new collaboration integrates Synopsys’ industry-leading virtual prototyping solutions for virtual Electronic Control Units(vECU) within Continental’s Automotive Edge (CAEdge) cloud-based development framework.

Segmental analysis

The software defined vehicle market forecast segmented into SDV type, electronic and electrical architecture, vehicle type, propulsion, offerings, application, and region. On the basis of SDV type, the market is divided into Semi-SDV and SDV. On the basis of electronic and electrical architecture, the market is categorized into distributed architecture, domain centralized architecture, zonal control architecture, and hybrid architecture. By vehicle type, the market is segmented into passenger cars and commercial vehicles. Depending on propulsion, the market is classified into ICE, electric, hybrid, and others. By offerings, the market is divided into software, hardware, and services. On the basis of application, the market includes infotainment systems, advanced driver assistance systems (ADAS), autonomous driving, telematics, powertrain control, battery management systems, V2X communication, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

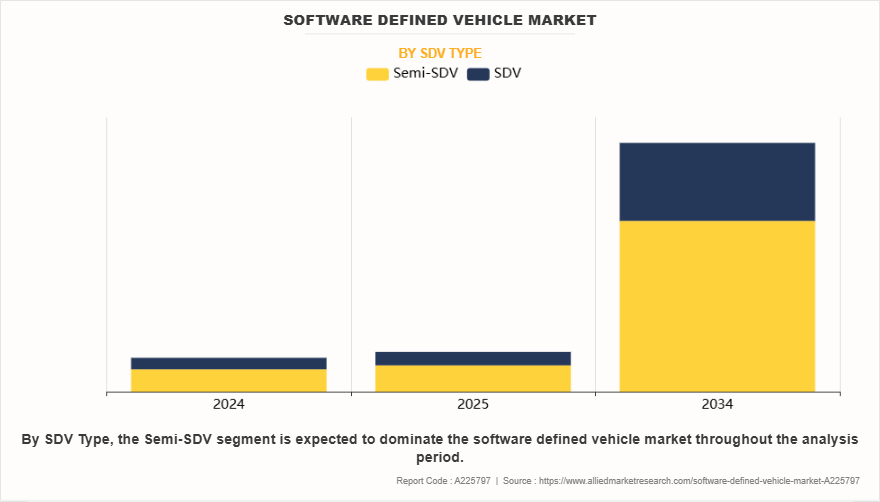

By SDV type

By SDV type, the software defined vehicle market demand is categorized into semi-sdv and sdv. The semi-sdv segment dominated the software defined vehicle market in 2024. Owing to, rising demand for smarter mobility solutions and the gradual shift toward software-centric vehicle architectures. Moreover, while not fully dependent on centralized computing like fully software-defined vehicles, semi-SDVs integrate software into key areas such as infotainment, driver assistance systems (ADAS), connectivity modules, and diagnostics. These vehicles often feature embedded systems that can process data from sensors, cameras, and GPS to support features such as adaptive cruise control, lane-keeping assistance, and real-time traffic updates.

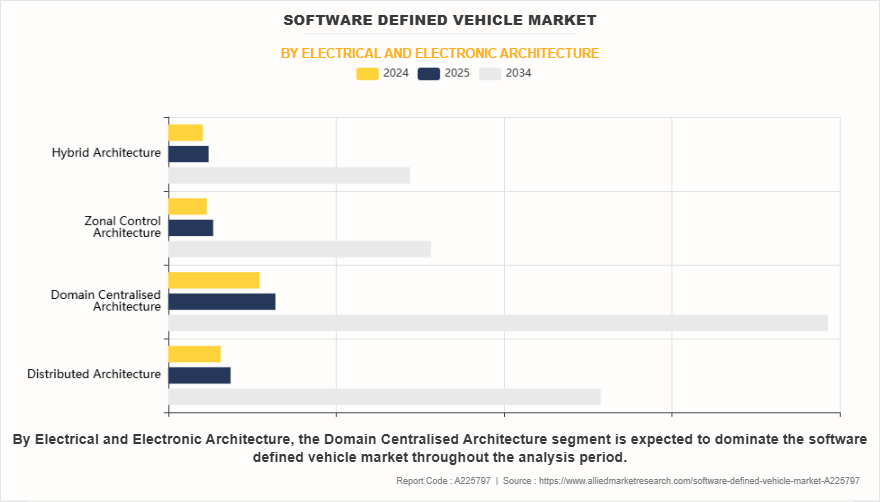

By Electrical and Electronic Architecture

By electrical and electronic architecture, the software defined vehicle market opportunity is categorized into distributed architecture, domain centralized architecture, zonal control architecture and hybrid architecture. The domain centralized architecture segment dominated the software defined vehicle market in 2024. Owing to, the modern vehicles incorporation of advanced features such as ADAS, infotainment, and powertrain management, managing these through a traditional distributed ECU setup becomes costly and cumbersome. Domain-centralized architecture addresses this by consolidating control within high-performance domain controllers, reducing the number of ECUs and wiring complexity, leading to lower manufacturing and maintenance costs.

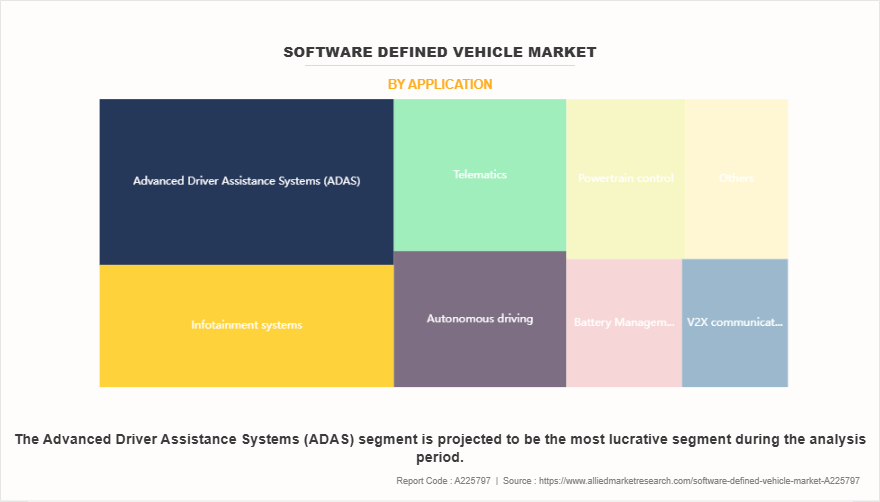

By Application

By application, the software defined vehicle market size is categorized into infotainment systems, advanced driver assistance systems (ADAS), autonomous driving, telematics, powertrain control, battery management systems, v2x communication and others. The advanced driver assistance systems (ADAS) segment dominated the software defined vehicle market in 2024. Owing to, increasing safety regulations, rising consumer expectations for growth in intelligent features, and the global push toward vehicle automation. As road safety concerns intensify and the automotive industry shifts toward semi-autonomous and autonomous driving, the demand for ADAS technologies such as adaptive cruise control, lane-keeping assistance, collision avoidance, and traffic sign recognition is growing.

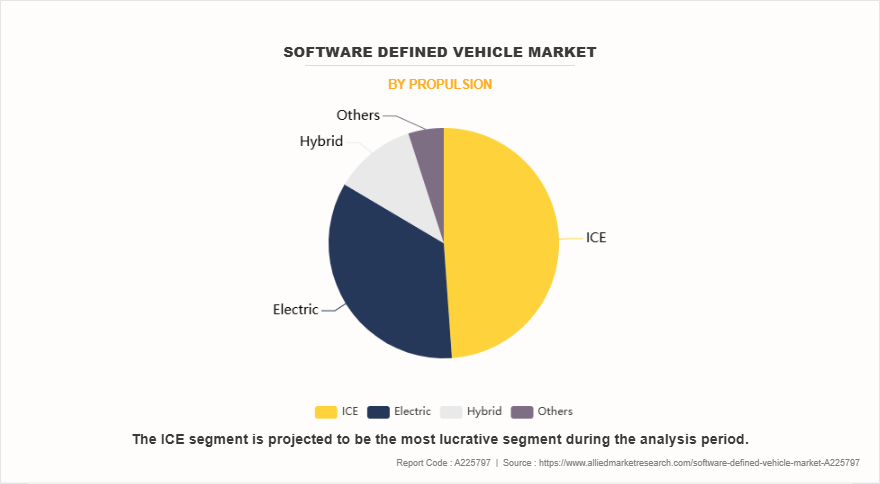

By Propulsion

By propulsion, the software defined vehicle industry is categorized into ice, electric, hybrid and others. The ice segment dominated the software defined vehicle market in 2024. The rising integration of software into internal combustion engine (ICE) vehicles is enhancing performance, efficiency, and system intelligence. As vehicles become more connected and digitally managed, ICE platforms are evolving with advanced control units that enable real-time monitoring, diagnostics, and fuel optimization. A key trend is the application of artificial intelligence (AI) and machine learning (ML) to support predictive maintenance, adaptive engine control, and emissions management. The adoption of high-performance computing (HPC) and edge computing allows for rapid data processing, enabling smarter engine calibration, improved drivability, and seamless integration with vehicle-wide software updates and connected services.

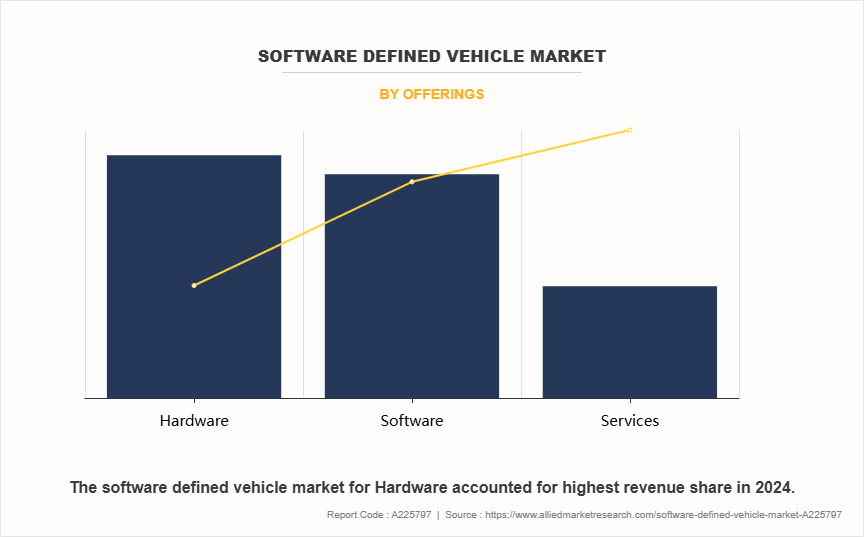

By Offerings

By offerings, the software defined vehicle market is categorized into software, hardware and services. The hardware segment dominated the software defined vehicle market in 2024. Owing to, hardware are a key part of software-defined vehicles (SDVs), providing the physical components that make the vehicle function. This includes electric motors, sensors, control units, and powertrains, which work together to deliver smooth and efficient driving. In SDVs, hardware is connected to advanced software that helps manage real-time data, improve system control, and enable vehicle connectivity. Technologies like high-performance computing (HPC) and embedded systems make hardware even more powerful, supporting features like predictive maintenance and adaptive driving.

By Vehicle

By vehicle, the software defined vehicle market is categorized into passenger cars and commercial vehicles. The passenger cars segment dominated the software defined vehicle market in 2024. Owing to, the increasing reliance on software in passenger cars is reshaping vehicle performance, safety, and overall user experience. Moreover, as vehicles becoming more connected and digitally managed, the software segment is evolving to enable real-time data processing, seamless system integration, and enhanced functionalities. There is also a key trend is the use of artificial intelligence (AI) and machine learning (ML) to improve adaptive features, predictive maintenance, and personalized in-car services. Software platforms are also utilizing high-performance computing (HPC) and cloud computing to process large amounts of data, optimizing everything from navigation and infotainment to driver assistance systems.

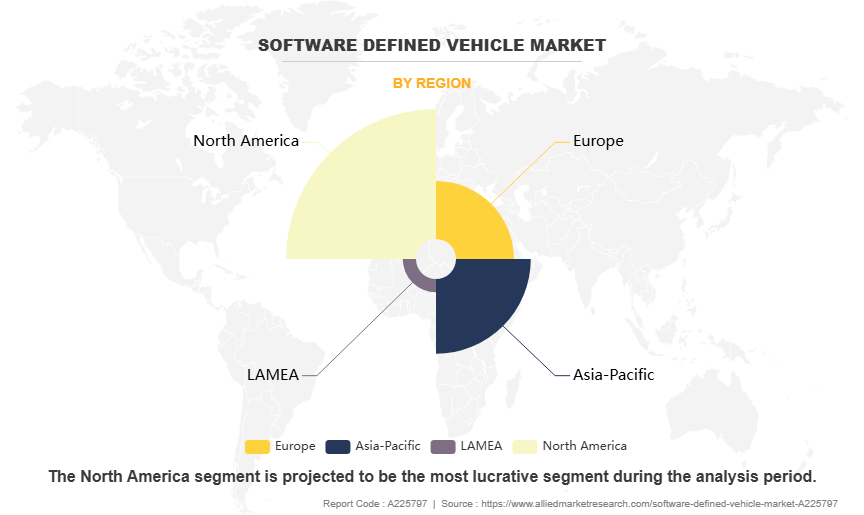

By Region

By Region the global software defined vehicle market is segmented into North America, Europe, Asia-Pacific, and LAMEA. The North America region dominated the global software defined vehicle market in 2024, owing to rising consumer demand for connected features, and the region’s strong position in the automotive industry. The U.S. plays a pivotal role in this transformation due to its leadership in tech innovation and the presence of major automotive manufacturers and software developers. The region's focus on enhancing vehicle autonomy, electrification, and connectivity has accelerated the integration of software-defined features across passenger and commercial vehicles. Additionally, the increasing emphasis on vehicle safety, driver assistance systems, and personalized user experiences has amplified the demand for SDVs. As automakers continue to prioritize over-the-air (OTA) updates, artificial intelligence, and cloud-based solutions, the adoption of software-defined vehicles is expected to expand rapidly in North America.

Growth of mobility-as-a-service (MaaS) and shared mobility ecosystems

The expansion of Mobility-as-a-Service (MaaS) and shared mobility ecosystems presents a significant opportunity for the software-defined vehicle (SDV) market. MaaS platforms integrate various transport options, such as ridehailing, car-sharing, and public transit, into a single digital service, requiring seamless connectivity and real-time data processing. Software-defined vehicles, with their advanced computing and cloud-based systems, are well-suited to support these platforms by enabling features such as remote vehicle access, dynamic routing, and predictive maintenance. For instance, companies such as Uber and Lyft are increasingly adopting connected vehicle technologies to optimize fleet management and improve user experience. In addition, the rise of shared mobility models, including car-sharing services such as Zipcar and Turo, relies heavily on software-driven functionalities such as keyless entry, usage-based billing, and vehicle diagnostics. SDVs enhance these services by allowing over-the-air (OTA) updates, ensuring that vehicles remain up-to-date with the latest software improvements without physical interventions. Furthermore, cities worldwide are promoting MaaS solutions to reduce traffic congestion and emissions, creating a growing demand for intelligent, software-enabled vehicles. Therefore, the expansion of MaaS and shared mobility ecosystems is driving automakers and tech firms to invest in SDV technologies to capture this emerging market.

Growth in over-the-air (OTA) updates

The increasing adoption of Over-the-Air (OTA) updates presents a significant opportunity for the market. OTA updates allow manufacturers to remotely upgrade and enhance vehicle software without requiring physical visits to service centers. This capability not only reduces maintenance costs but also enhances customer convenience by providing timely updates for features, performance improvements, and security patches. One of the key benefits of OTA updates is their ability to ensure vehicles remain up to date with the latest technologies and safety protocols throughout their lifecycle. For instance, a leading automaker like Tesla has successfully utilized OTA updates to introduce new features such as enhanced autopilot capabilities and improved energy efficiency. This has helped the company maintain a competitive edge and build customer trust. Moreover, OTA updates support the growing trend of connected and autonomous vehicles by enabling real-time updates to navigation systems, infotainment features, and vehicle-to-everything (V2X) communication. This functionality is particularly valuable in addressing emerging issues or vulnerabilities, ensuring the vehicles remain reliable and secure.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the software defined vehicle market analysis from 2024 to 2034 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global software defined vehicle market trends, key players, market segments, application areas, and market growth strategies

Software Defined Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 1902.9 billion |

| Growth Rate | CAGR of 22.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By SDV Type |

|

| By Electrical and Electronic Architecture |

|

| By Application |

|

| By Propulsion |

|

| By Offerings |

|

| By Vehicle |

|

| By Region |

|

| Key Market Players | General Motors, Volkswagen Group, Rivian, Li Auto Inc., Aptiv, NVIDIA Corporation, Robert Bosch GmbH, QUALCOMM Incorporated, Tesla, Continental AG |

The integration of AI and ML are the upcoming trends in the software defined vehicle industry.

Advanced driver assistance systems (ADAS) is the leading application of the Software defined vehicle Market.

North America is the largest regional market for software defined vehicles.

The software defined vehicle market was valued at $258,940.6 million in 2024 and is estimated to reach $1,902,945.0 million by 2034, exhibiting a CAGR of 22.61% from 2025 to 2034

Aptiv PLC, Tesla, Inc., Continental AG, NVIDIA Corporation, Robert Bosch GmbH, Li Auto Inc., Rivian Automotive, Inc are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...