Tea Polysaccharides Market Research, 2032

The global tea polysaccharides market size was valued at $886.7 million in 2022, and is projected to reach $1.9 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

Tea polysaccharides are a type of complicated carbohydrates found in tea leaves. Polysaccharides are lengthy, interconnected chains of molecular sugars. They primarily originate from the innermost cells of tea plants such as Camellia sinensis, which are commonly utilized for making a variety of teas such as green tea, black tea, and oolong tea.

Tea polysaccharides are mainly extracted from tea leaves through an extensive procedure. When fresh tea leaves shrivel up, they lose moisture and develop more flexible. The browned leaves are subsequently rolled or shredded, which breaks down cell walls and stimulates polysaccharide release. The leaves are then oxidized (fermented) in the event of black tea but not in the scenario of green tea. The tea leaves are dried after oxidation to eliminate extra moisture. The dried leaves are then finely processed to make tea powder. In the end, tea polysaccharides are removed from powdered tea using solvents such as hot water or alcohol by procedures such as extraction with hot water, ultrasonic-assisted extraction, or microwave-assisted extraction.

The global tea polysaccharides market was significantly impacted by the COVID-19 pandemic. As the disease affected the entire globe, governments enacted tight lockdown measures and travel restrictions, disrupting tea polysaccharide supply lines and distribution networks. Closures of tea farms, processing plants, and shipping routes reduced market output and availability of tea polysaccharides. Furthermore, consumer behavior altered as consumers prioritized basic commodities and lowered discretionary expenditure on non-essential products such as tea polysaccharides.

The surge in requirement for functional and natural components has a significant impact on the tea polysaccharides industry. In the past five years, there has been a noticeable trend in consumer tastes toward healthier options and an increased focus on the nutritional content of food and beverages. Consumers look for goods that provide extra health advantages beyond basic nutrition, which has resulted in the increased popularity of functional additives.

Tea polysaccharides are synthesized and obtained through withered tea leaves and have received appeal due to their beneficial functional qualities. These tea polysaccharides ingredients are widely recognized for their anti-bacterial, antioxidant, and immunity-boosting capabilities, which have been statistically linked to a number of health benefits such as enhanced heart health, blood sugar regulation, and immunotherapy. As a result, tea polysaccharides have come to be recognized as an important ingredient in the preparation of nutritious foods and beverages.

The global consumers are searching or positive and organic food ingredients to recover from their illness and maintain their health, with a stronger focus on wellness maintenance and self-care. Therefore, there is a growing need for food products rich in tea polysaccharide such as therapeutic teas, vitamin and mineral supplements, and nutritious drinks.

The process of manufacturing and extracting tea polysaccharides is occasionally complicated and resource-intensive, adding to higher prices. Tea leaves contain low amounts of polysaccharides, necessitating vast volumes of raw material to generate significant yields. This complicates obtaining sufficient tea leaves and raises total manufacturing expenses.

In addition, the extraction procedure itself is often time-consuming and costly. Several extraction procedures, including hot water extraction, enzyme hydrolysis, and ultrasound-assisted extraction, are used for the separation and purification of tea polysaccharides. These processes frequently need specialized equipment and expert labor, raising total manufacturing costs.

Elevated extraction and manufacturing costs of tea polysaccharides influence the affordability and financial viability of adding this component to food and beverage items. Manufacturers find it difficult to justify the expenses related to tea polysaccharides, especially when there are cheaper alternatives available.

Furthermore, the high prices limit the market availability of tea polysaccharides, as smaller manufacturers or enterprises with low resources find it difficult to invest in the necessary manufacturing and extraction methods. This scarcity further limits the accessibility and use of tea polysaccharides in a broader range of goods.

The demand from the food manufacturers for tea polysaccharides in the production of nutritional and health supplements is an important opportunity for the tea polysaccharides market growth. Dietary supplements and nutritional products are becoming increasingly popular among consumers who are searching for reliable and efficient solutions for boosting their general well-being and health. Given their beneficial therapeutic characteristics and natural source, tea polysaccharides were recently identified as a key organic constituent for the creation of these products. Tea polysaccharides offer a number of health-promoting qualities, making them valuable constituents in nutritional supplements and nutritional supplements. Furthermore, tea polysaccharides have preventing wrinkles, antibacterial, and immune-boosting qualities, which are helpful for many areas of person's wellness and overall health.

The increase in consumer requirement for nutraceuticals and nutritional supplements, and an increase in demand for both organic and functional components, creates a favorable market environment for the sales of tea polysaccharides. As individuals become more conscious of the possible health advantages of these substances, consumer tastes for goods incorporating tea polysaccharides have evolved. As a result, producers are exploring the incorporation of tea polysaccharides into nutritional and dietary goods, consequently increasing the market exposure of tea polysaccharides in this area. Green tea polysaccharides, which are extracted from green tea leaves and have long been renowned for their health advantages, have gained in recognition as consumer appetite for healthy and organic ingredients has expanded. Green tea in general has gained prominence mainly due to its antioxidant characteristics and links to a variety of health advantages, thus the product manufacturers have incorporated tea extracts in functional meals, drinks, and nutritional supplements. The surge in popularity of functional drinks and the increased emphasis on preventative healthcare provide new opportunities for green tea polysaccharides. Green tea polysaccharides are expected to see continued development and market expansion in the global marketplace due to their various uses and consumer appeal.

Segmental Overview

The tea polysaccharides market is segmented into type, form, application, and region. By type, the market is classified into oolong tea, black tea, green tea, and others. By form, the market is bifurcated into powder and liquid. By application, the market is classified into food & beverages industry, nutraceuticals industry, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Spain, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Type

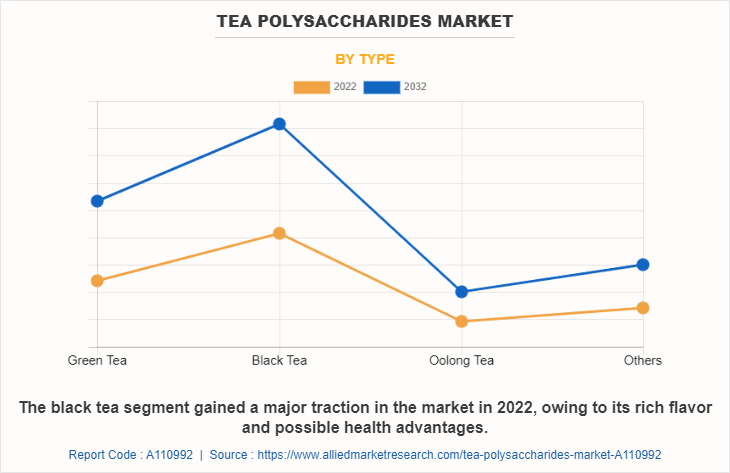

On the basis of type, the black tea segment dominated the market in 2022 and is expected to sustain its market share during the forecast period. Black tea, noted for its rich flavor and possible health advantages, has gained appeal among health-conscious customers. This rise in demand for black tea and its extracts offers prospects for its incorporation into a wide range of goods, including nutritional beverages, supplements, and cosmetics formulations.

By Form

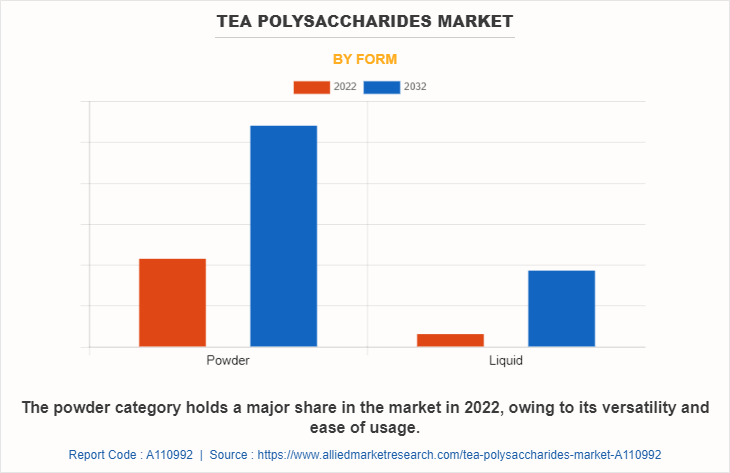

According to the tea polysaccharides market demand, on the basis of form, the powder segment dominated the market in 2022 and is expected to sustain its market share during the forecast period. The versatility of tea polysaccharides powder in composition and ease of usage makes it appealing to producers. The increased understanding of the potential health advantages of tea polysaccharides, including antioxidant and immune-boosting qualities, has pushed their inclusion into a variety of food, beverage, and nutraceutical products.

By Application

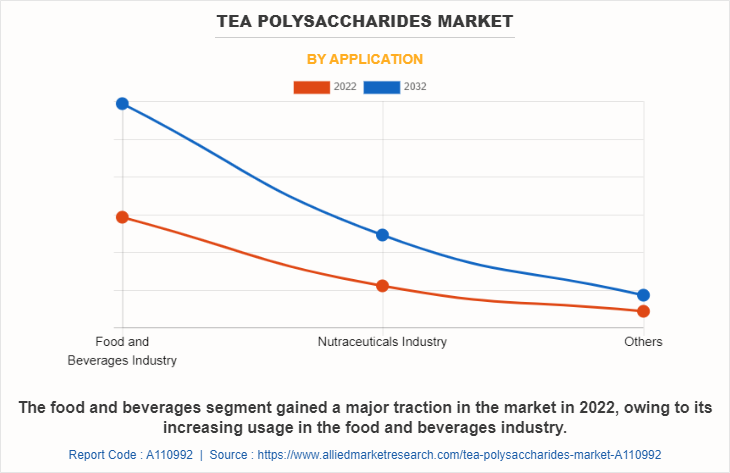

By application, the food & beverages segment dominated the market in 2022 and is expected to sustain its market share during the tea polysaccharides market forecast period. The usage of tea polysaccharides is increasing as manufacturers are incorporating a broad range of food & beverage items, including immunity-boosting teas, energy bars, and nutritional supplements. The solubility of tea polysaccharides as an ingredient makes them a potential component that can be used in the majority of dietary products that will assist in improving the nutritional profile and functional qualities of their goods.

By Region

By region, Europe led the tea polysaccharides market in 2022 and is expected to be dominant during the forecast period. Functional food products are widely used for weight management, clinical nutrition, and cardio health in many European countries. An increase in investments by several small and midsized food manufacturing companies in developing countries has increased the requirement for organic ingredients such as tea polysaccharides.

Competition Landscape

The players that operate in the global tea polysaccharides market have adopted various developmental strategies. In February 2021, International Flavors & Fragrances Inc. announced the merger of DuPont’s Nutrition & Biosciences. This merger is expected to further create a leading ingredients and solutions provider for customers across a broad range of end-markets. The strategy is implemented to expand their tea polysaccharides market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Xi'an Sunhealth Biotech Co., Ltd, Wellgreen Technology Co., Ltd, Seebio Biotech (Shanghai) Co., Ltd, Finlays, International Flavors & Fragrances Inc. IFF, Mark T. Wendell Tea Company, RFI Ingredients, LLC., Martin Bauer Group GmbH & Co. KG, Hunan Nutramax Inc., and Tea Source.

Examples of Merger in the Global Tea Polysaccharides market

In February 2021, International Flavors & Fragrances Inc. announced merger of DuPont’s Nutrition & Biosciences. This merger will further create a leading ingredients and solutions provider for our customers across a broad range of end markets.

Examples of Expansion in the Global Tea Polysaccharides market

In October 2022, International Flavors & Fragrances Inc. announced the opening of its new Singapore innovation center to integrate the technologies, capabilities, and expertise business divisions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tea polysaccharides market analysis from 2022 to 2032 to identify the prevailing tea polysaccharides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tea polysaccharides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tea polysaccharides market trends, key players, market segments, application areas, and market growth strategies.

Tea Polysaccharides Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.9 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | TeaSource LLC, Finlays, RFI Ingredients, Martin Bauer Holding GmbH & Co. KG, The Mark T. Wendell Tea Company, International Flavors & Fragrances Inc., Seebio Biotech (Shanghai) Co., Ltd, Xi'an Sunhealth Biotech Co., Ltd, Wellgreen Technology Co.,Ltd., Hunan Nutramax Inc. |

Analyst Review

As per the perspective of top-level CXOs, the global tea polysaccharides market is expected to offer remunerative business opportunities in developing economies such as India and Brazil. This is attributed to an increase in disposable income, awareness regarding health concerns, and growing cardiovascular diseases.

The CXOs further added that manufacturers are focusing on displaying the transparency of the ingredients, which are added to the product, as the consumers choose products by reading the labels. In addition, consumers prefer products with organic and plant-based ingredients. Moreover, the increasing application of functional food in sports nutrition and clinical nutrition is further boosting the growth of the tea polysaccharides market.

Furthermore, the rise in the rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs. These online platforms are one of the easiest ways to create awareness about the benefits of the tea polysaccharide with respect to various diseases including cardiovascular diseases, cancer, and obesity-linked diseases. Hence, tapping into such markets is expected to create potential opportunities for the expansion of the global tea polysaccharides market.

The tea polysaccharides market size was valued at $886.7 million in 2022 and is projected to reach $1,848.2 million by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

The global tea polysaccharides market registered a CAGR of 7.7% from 2023 to 2032.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the tea polysaccharides market report is from 2023 to 2032.

The top companies that hold the market share in the tea polysaccharides market include Xi'an Sunhealth Biotech Co., Ltd, Wellgreen Technology Co., Ltd, Seebio Biotech (Shanghai) Co., Ltd, Finlays, International Flavors & Fragrances Inc, and others.

The tea polysaccharides market report has 3 segments. The segments are type, form, and application.

The emerging countries in the tea polysaccharides market are likely to grow at a CAGR of more than 7.7% from 2023 to 2032.

Post-COVID-19, the tea polysaccharides market is witnessing new heights of growth and is expected to recover its losses in the next 1-2 years. The change in consumer consumption patterns has increased the popularity of nutritional products that use natural tea polysaccharides in the market.

Europe will dominate the tea polysaccharides market by the end of 2032.

Loading Table Of Content...

Loading Research Methodology...