Automotive Operating System Market Overview

The global automotive operating system market was valued at USD 5.4 billion in 2022, and is projected to reach USD 20.4 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032. Adoption of ADAS features and connected car services fuels demand for advanced automotive operating systems. Emerging 5G, AI, and autonomous vehicles create lucrative growth opportunities.

Key Market Insights

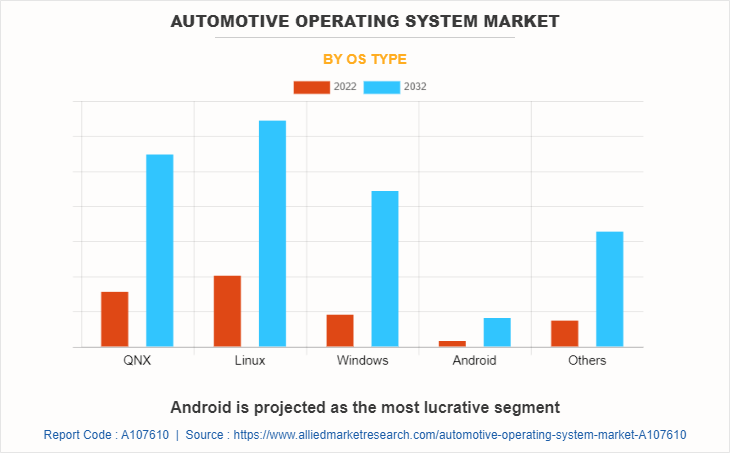

- Android OS segment poised for significant growth.

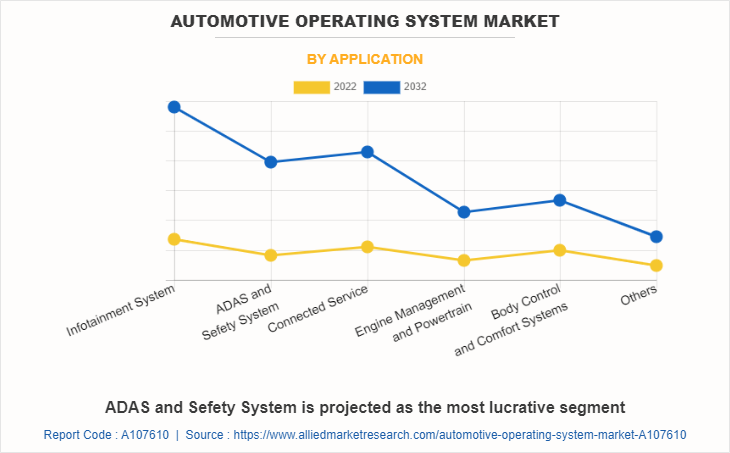

- ADAS & Safety Systems driving strong adoption.

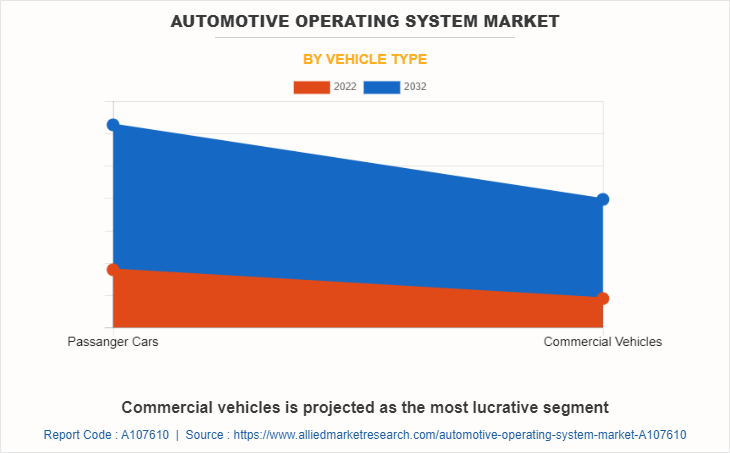

- Commercial vehicles leading OS integration.

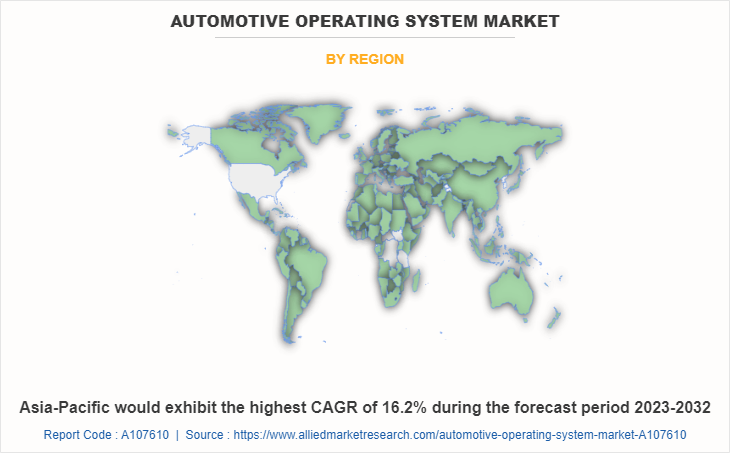

- Asia-Pacific projected to record highest CAGR.

Market Size & Forecast

- 2032 Projected Market Size: USD 20.4 billion

- 2022 Market Size: USD 5.4 billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 14.6%

Report Key Highlighters:

- The automotive operating system market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The market is highly fragmented, with several players including Siemens, Renesas Electronics Corporation, BlackBerry Limited, Alphabet Inc., Luxoft, DXC Technology Company, Automotive Grade Linux, NVIDIA Corporation, Wind River Systems, Inc., Green Hills Software, and Microsoft Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, expansion, etc. of the players operating in the automotive operating system market industry.

Introduction

An automotive operating system, also known as an automotive OS, is a focused software platform designed to power the various electronic systems inside a vehicle. It provides the services and required infrastructure to support the functionalities and connectivity of automotive components, such as telematics, infotainment system, driver-assistance systems, and other vehicle control systems. Systems serve as the foundation for managing and coordinating the complex interactions between hardware and software in modern vehicles.

These operating systems should meet strict constraints in terms of consistency, real-time awareness, and safety. Must make sure the secure and effective performance of essential tasks while providing the required flexibility to integrate new features and support over-the-air updates.

Market Dynamics

The automotive operating system market outlook is driven by factors such as the adoption of Advanced Driver Assistance Systems (ADAS) features in vehicles, growing adoption of connected car services, and interference of innovative technologies for advanced UI which is expected to drive the market growth. However, the absence of regimented protocols for software program development, imperfect connected infrastructure, and challenges in troubleshooting and sustaining automotive operating systems are impeding the progress of the market. Further, the potential of 5G and AI, growing developments in semi-autonomous and autonomous vehicles, and data monetization in the extended automotive ecosystem are some of the factors that are expected to offer lucrative opportunities for market growth. In addition, around 20.1% of the automotive operating system market share is in the automotive software industry.

Moreover, user interface is an interactive platform that is used as a medium for the user and the application to interact. New vehicles are being equipped with innovative technologies such as visual info-gratification including digital speedometers, climate control, navigation, driving assistance and other car settings. These digital infographics systems can be accessed through a touchscreen display, which is placed on the vehicle’s dashboard. In addition, in order to provide the same digital human experience to the users, leading automotive companies are improving the user interface (UI) inside the next vehicle generation by adding digital screens and human interfaces to the interior of a car. Such interfaces require software for technology integration, which in turn boosts the automotive software market growth. For instance, in January 2020, Rightware, the leading provider of automotive user interface software, introduced a new Kanzi reference HMI (Human-Machine Interface) platform, which combines the company’s suite of automotive user interface design software into an integrated solution to help automakers and suppliers deliver the best possible user experience in multi-display digital cockpits.

In addition, Startups such as Waymo, Uber, Embark, Einride, TuSimple, Ike and others have also started developing self-driving electric vehicles which integrated with advance operating system. For instance, Waymo has started testing its self-driving trucks since January 2020. Similarly, TuSimple plans to operate autonomous routes between Pheonix and Tucson in Arizona and some areas in Texas. Further, in May 2019, Einride had started its testing for driver-less trucks. In January 2019, Daimler announced an investment of $570 million for self-driving electric vehicles. Thus, self-driving technology will increase demand for electric vehicles in the long run due to the various advantages such as reduced accident risk, easy use, presence of value-added features among others. This technology is expected to mature by the next 5-6 years. Thus, the development of self-driving electric vehicle technology is opportunistic forautomotive operating system market growth.

The global automotive operating systems market is segmented based on OS type, vehicle type, application, and region. By OS type, the market is divided into QNX, Linux, windows, android, and others. Further, based on vehicle type, the market is bifurcated into passenger cars and commercial vehicles. As per application, the market is segmented into infotainment systems, ADAS & safety systems, connected services, engine management & powertrain, body control & comfort systems, and others. Region-wise, the market is classified into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

North America includes countries such as the U.S., Canada, and Mexico. The growing vehicle production, increase in the number of connected cars developments, rapidly changing in-vehicle electronics architecture, C-V2X technology developments, and expansion of leading OEMs are the factors contributing to automotive software market growth in North America.

For instance, in September 2020, Mitsubishi Motors North America Inc. entered into a partnership with leading Internet-of-Things technology providers Aeris and Dealer-FX to leverage connected car technology. Through integrations with the Aeris Mobility Services and Dealer-FX ONE platforms, the My MITSUBISHI CONNECT mobile app will enable the Mitsubishi Eclipse Cross drivers service to view real-time service and maintenance needs, as reported by the vehicles.

Which are the Top Automotive Operating System companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Automotive Operating System industry.

- Siemens

- Renesas Electronics Corporation

- BlackBerry Limited

- Alphabet Inc.

- Luxoft, A DXC Technology Company

- Automotive Grade Linux

- NVIDIA Corporation

- Wind River Systems, Inc.

- Green Hills Software

- Microsoft Corporation

What are the Recent Developments in the Automotive Operating System Market

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

In January 2023, NVIDIA Corporation entered into a partnership with Hon Hai Technology Group (Foxconn), a leader in technology manufacturing. The partnership combines the strengths of both companies and enables them to develop an automated and autonomous vehicle platform that offers intelligent driving solutions.

In November 2022, Alphabet Inc. through its subsidiary Google entered into a partnership with Renault Group, a French automobile manufacturer. This strategic move offers to accelerate the digital transformation of Renault Group by bringing the expertise of the company in cloud, AI, and Android to offer a secure, highly personalized experience.

In May 2022, Blackberry Limited signed an agreement with Magna International Inc., a global automotive supplier. Through this collaboration, it provides QNX software including the QNX OS for Safety, QNX Software Development Platform, and QNX Platform for ADAS, for system-level integration, performance optimization, and solution validation.

In February 2021, Alphabet Inc. through its subsidiary Google entered into a partnership with Ford. Its Android operating system is integrated into Ford and Lincoln vehicles to design new consumer services and modernize internal operations.

What are the Top Impacting Factors

Key Market Driver

Increase in demand for connected and autonomous vehicles

The automotive industry has witnessed significant advancements associated with in-vehicle connectivity, machine learning, and ADAS, enabling vehicles to communicate with other vehicles, infrastructure, and external devices. This connectivity offers enhanced safety features, efficient traffic management, and improved user experiences, thereby leading to increased demand for operating systems supporting these features. For instance, in September 2022, Qualcomm Technologies, Inc. entered a collaboration with Red Hat, a leading provider of open-source solutions, to bring functional-safety certified (ASIL-B) Linux-based operating systems to next-generation vehicles that utilize Snapdragon Digital Chassis platforms -- a set of open and scalable cloud-connected platforms designed for automotive telematics and connectivity, digital cockpit, and advanced driver assistance. Utilizing Red Hat in-vehicle operating systems with Snapdragon Digital Chassis Platforms, automakers may help advance the development of software-defined vehicles. Moreover, the increase and exploitation of self-driving vehicles have expanded thrust in the last few years. Such vehicles vary heavily on enhanced operating systems to handle various tasks, such as sensor combination, decision-making algorithms, and real-time data processing.

Rise in the trend of connectivity solution

Smartphones have changed the definition of connectivity over time. People wish to stay connected with the outer world even while traveling. Now that connectivity has become the need of the hour, automobile manufacturers adopt connectivity solutions in their vehicles to boost their automobile sales. Consumers are expecting their vehicles to perform tasks similar to computers and smartphones. Adding connectivity solutions in the vehicle has become the topmost priority for automobile manufacturers.

Many connectivity solutions are integrated into modern cars that require internet service to perform their respective functions. Connectivity can be provided in a car using embedded, integrated, or tethered connectivity solutions. One of these connectivity solutions is used to offer Internet links to the driver as well as the passengers who travel in the vehicle. An in-car trouble spot can be created to present Internet access to all the devices within the vehicle with the help of a smartphone, modem, or connectivity device. Therefore, the rise in the trend of connectivity solutions drives the growth of the connected cars market.

Restraints

Increasing automobile system complexities

Vehicles converted more interconnected and advanced, and the number of electronic components, sensors, and software systems involved in their operation is growing exponentially. The incorporation of AI and machine learning algorithms into complicated automotive systems presents several challenges. The computational requirements of these algorithms are sizable. They require significant processing power and memory, which may impose upgrades to the existing hardware infrastructure or even a complete redesign of the system architecture.

Moreover, gathering and managing the necessary data for training and testing these algorithms can be a daunting task. AI and machine learning models rely on vast amounts of high-quality and diverse data to learn effectively. Ensuring data integrity, synchronization, and compatibility across various sensors and sources within the automotive system can be complex and time-consuming.

Opportunity

The rising market for electric and hybrid vehicles

Automobile companies focus on the production of advanced electric vehicle systems that are expected to have lower particular emissions at relatively lowers costs. Companies have also started producing downsized engines to be implemented in vehicles as smaller engines help achieve the upcoming BHARAT STAGE VI emission norms. This is because they produce less emissions as compared to heavier and larger engines. The compactness and cost-effectiveness of these downsized small engines also add another dimension to their usefulness. Thus, the development of advanced GDI systems presents various opportunities for leading players in the future. Electric and hybrid vehicles rely on complex systems for managing power distribution, battery performance, and energy optimization.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive operating system market analysis from 2022 to 2032 to identify the prevailing automotive operating system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive operating system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive operating system market trends, key players, market segments, application areas, and market growth strategies.

Automotive Operating System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.4 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By OS Type |

|

| By Application |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Automotive Grade Linux, Alphabet Inc., BlackBerry Limited, Wind River Systems, Inc., LUXOFT, A DXC TECHNOLOGY COMPANY, Green Hills Software, Microsoft Corporation, Siemens, Renesas Electronics Corporation., NVIDIA Corporation |

The global automotive operating system market was valued at $5.4 billion in 2022, and is projected to reach $20.4 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032.

The Linux OS is the leading application of Automotive Operating System Market.

Europe is the largest regional market for Automotive Operating System Market.

The upcoming trends are adoption of Advanced Driver Assistance Systems (ADAS) features in vehicles, increasing adoption of connected car services, and intervention of innovative technologies for advanced UI

Siemens, Renesas Electronics Corporation, BlackBerry Limited, Alphabet Inc., Luxoft, A DXC Technology Company, Automotive Grade Linux, NVIDIA Corporation, Wind River Systems, Inc., Green Hills Software and Microsoft Corporation.

Loading Table Of Content...

Loading Research Methodology...