Banking-as-a-Service Market Overview

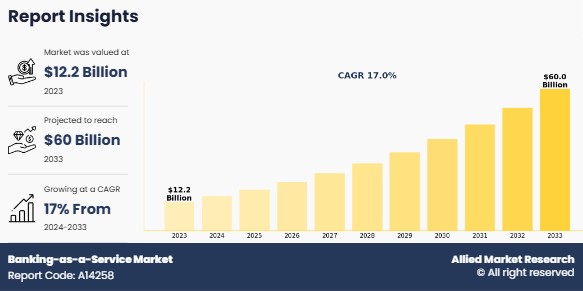

The global banking-as-a-service market was valued at $12.2 billion in 2023, and is projected to reach $60 billion by 2033, growing at a CAGR of 17% from 2024 to 2033. Rise in the adoption of open banking, the increase in the demand for embedded financial solutions, and the surge in digital transformation, enabling innovation, efficiency, enhanced customer experiences, fintech collaboration, and expand globally, contribute toward the growth of the market.

Market Dynamics & Insights

- The banking as a service industry in North America held a significant share of 31% in 2023.

- The banking as a service industry in China is expected to grow significantly at a CAGR of 17.5% from 2023 to 2032.

- By component, the service segment is one of the dominating segment in the market, accounting for the revenue share of 67% in 2023.

- By type, the cloud-based bank-as-a-service segment is the fastest growing segment in the market, growing at a CAGR of 22.0% from 2023-2032.

Market Size & Future Outlook

- 2023 Market Size: $12.2 Billion

- 2033 Projected Market Size: $60 Billion

- CAGR (2024-2033): 17%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

What is meant by Banking as a Service

Banking-as-a-Service (BaaS) is transforming financial ecosystems by enabling non-banking entities to offer financial products seamlessly through APIs and embedded finance solutions. This trend is driven by increasing digitalization, customer demand for personalized financial experiences, and partnerships between fintech companies and traditional banks.

Banking as a Service (BaaS) is a financial ecosystem where licensed banks or financial institutions provide their core banking services through APIs (Application Programming Interfaces) to third-party businesses, fintech companies, or non-banking enterprises. This model enables businesses to embed financial services such as payments, loans, savings accounts, and card issuance directly into their own platforms, enhancing customer experience and operational efficiency. The banking-as-a-service market operates at the intersection of traditional banking and technology, driven by the rise of digital-first consumer expectations and the growth of fintech innovation. It involves service providers, including banks, fintech companies, API platforms, and developers, facilitating end-to-end financial service delivery. These offerings are customized to serve to varied industries like e-commerce, telecommunications, healthcare, and more. The service is characterized by its ability to democratize financial services, breaking down barriers for businesses to access banking infrastructure without heavy investments or regulatory hurdles. It thrives on trends such as open banking, advancements in API technology, and the adoption of cloud computing. In addition, banking-as-a-service market growth is shaped by regulatory developments such as PSD2 in Europe, which mandate open data sharing between financial institutions and third parties. With its scalability and flexibility, the banking-as-a-service industry supports business models like white-label banking, allowing non-financial entities to launch branded financial products. This not only diversifies revenue streams but also promotes a competitive landscape, accelerating the transformation of traditional banking services into digital, modular solutions.

On the basis of component, the services segment attained the highest banking-as-a-service market share in 2023 in the banking-as-a-service market. This is attributed to the fact that the scalability of BaaS platforms, enterprises, and financial institutions modify their banking offerings in response to changing banking-as-a-service market demands. BaaS solutions are appealing to a variety of companies due to their scalability and flexibility, particularly those that are growing or have fluctuating transaction volumes. Meanwhile, the platform segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that a variety of banking services are provided by banking-as-a-service (BaaS) service providers, enabling enterprises and financial institutions to contract out non-core banking tasks. Services including account administration, payments, compliance, and risk management are included in this. Businesses are able to concentrate on their core capabilities by outsourcing such functions.

On the basis of region, North America attained the highest banking-as-a-service market size in 2023, owing to the region’s advanced technology infrastructure, high adoption of digital banking services, and the presence of leading financial technology companies. The U.S., in particular, has a strong banking ecosystem and a well-established regulatory framework, which encourages the growth of the banking-as-a-service industry. On the other hand, Asia-Pacific is projected to be the fastest-growing region during the banking-as-a-service market forecast period. This growth is attributed to the fact that a large part of Asia-Pacific is a highly tech-savvy population. Asia-Pacific has witnessed a rapid adoption of financial solutions. BaaS is used by fintech companies in the area to provide creative financial services, which help the market expand quickly.

The report focuses on growth prospects, restraints, and trends of the banking-as-a-service market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the banking-as-a-service market.

Banking as a Service Market Segment Review

The banking-as-a-service market is segmented on the basis of , and region. On the basis of component, the market is divided into platform and service. By type, it is bifurcated into API-based Bank-as-a-service and cloud-based bank-as-a-service. By end user, it is categorized into banks, fintech corporation/NBFC, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Banking as a Service Market Competitive Analysis

The report analyzes the profiles of key players operating in the banking-as-a-service market such as Banco Bilbao Vizcaya Argentaria, Block, Inc, Bnkbl Ltd, ClearBank Ltd, Green Dot, MatchMove Pay Pte Ltd, Solaris SE., Starling Bank, Stripe, Inc., and Treasury Prime. These players have adopted various strategies to increase their market penetration and strengthen their position in the banking-as-a-service market.

What are the recent partnership in the banking-as-a-service market

- In November 2023, Zile Money partnered with Sunrise Bank to offer banking-as-a-service. The partnership has the potential to completely transform the fintech industry by delivering unmatched efficiency to real-time monitoring and customer onboarding, all the while maintaining Sunrise Bank's gold standard for risk and compliance. Furthermore, this collaboration offers unprecedented integration prospects, with Zil Money's strong infrastructure, up-and-coming fintechs may now easily provide a full range of financial services, from card issuance to banking and payments, all under Sunrise Bank's strict compliance guidelines.

- In October 2022, Treasury Prime partnership with First Internet Bank to offer banking-as-a-service. With this partnership, Treasury Prime will continue to expand its network of 15 financial institutions across the country, which is already the largest in the business. Furthermore, the Tech-forward clients will be able to grow their services and reach a wider audience by utilizing Treasury Prime's state-of-the-art API connections and BaaS capabilities in conjunction with First Internet Bank's strong infrastructure and compliance systems. Treasury Prime presently collaborates with two of the top neobanks in the market: Zeta, which provides a joint account to support modern families, and Challenger, which offers an employer-sponsored savings program to assist employees in saving with every paycheck automatically.

What are the Top Impacting Factors in Banking as a Service Sector

Increase in use of digital transformation technology in banks

Digitization is the process of converting data or information into a digital format with the adoption of advanced technology. It plays a critical role in the banking sector, owing to the increasing need among banks to provide enhanced customer services and to improve the security of the customer. Furthermore, banking-as-a-service helps banks to offer digital payment service to their customers and saves time on the debt collection process, thus propelling the growth of the banking-as-a-service market. In addition, the rise in demand for digital transformation technology in the banking and financial institutions and increase in dependency of various banks on banking-as-a-service solutions drive the growth of the market. In addition, banking-as-a-service market players across the globe are adopting various advanced technologies such as blockchain technology, big data, and artificial intelligence to increase productivity with minimal resource utilized, which drive the growth of the market. Furthermore, digital transformation encourages banks to have an innovative culture. Banks may create and implement new services more quickly by utilizing cutting-edge technologies like microservices, cloud computing, and Application Programming Interfaces (APIs). Through APIs, BaaS providers provide pre-built, modular banking services, saving banks time and money by avoiding the need to develop new features from the ground up. Therefore, the increase in use of digital transformation technology in banks has driven the demand for banking-as-a-service market.

Streamlining financial services

The banking-as-a-service platform allows financial service access to third-party organization through API. In addition, the platform helps banks and FinTech to streamline their financial services as well as to improve their services and enhances customer experience, which drives the growth of the banking-as-a-service market. In addition, it helps financial institutions to offer customer-embedded financial service and improve funding sources to serve their massive customer bases, which fosters the growth of the market across the globe. Moreover, the surge in need among banks to meet customer requirement and to provide high security to customers in critical transactions accelerate the growth of the market. In addition to this, various banks are facing issues in streamlining their money transaction process, owing to which banks are shifting their focus toward banking-as-a-service platform, which notably contributes toward the growth of the global banking-as-a-service market. Banking-as-a-service allows companies and financial institutions to contract with specialist service providers to handle certain banking tasks. They can attain operational efficiency and concentrate on their main skills by doing this. Compared to internal operations, BaaS suppliers frequently possess the infrastructure and knowledge necessary to manage these tasks more effectively. Therefore, streamlining financial services is driving the demand of the banking-as-a-service market.

Increase in cyber-attacks

Increase in cyber-attacks in the financial sectors to collect the customer’s information is restricting the growth of the banking-as-a-service market across the globe. Although the demand for banking-as-a-service is increasing continuously, the rise in the threat of cyber-attacks hampers the growth of the market. In addition, lack of server security, insecure or ineffective data storage, and inadequate authentication & authorization while using banking services are limiting the growth of the banking-as-a-service market. Furthermore, the increase in the volume of customers financial information in banks and lack of cyber security solutions hinder the growth of the market. Moreover, financial institutions and end consumers may lose trust as a result of successful cyberattacks. Customers and companies may be reluctant to adopt or use BaaS platforms if they believe they are subject to security breaches. This could have an adverse effect on the market's growth for BaaS. In addition, cyberattacks may cause downtime, operational problems, and monetary losses. Financial institutions can reconsider their dependency on outside providers if security incidents cause service interruptions on BaaS platforms, which could hinder the expansion of the BaaS market. Therefore, increase in cyber-attacks are hampering the growth of the banking-as-a-service market.

Increase in demand for banking-as-a-service infrastructure to improve the business value

Developing economies offer significant opportunities for banking-as-a-service to expand their business by offering easier access to capital and financial services. In addition, banking-as-a-service helps a business to monitor the financial health of business and carry out advanced financial services for business & customers, within platform without moving outside, which accelerate the adoption of banking-as-a-service platform among the business. Moreover, monitoring all transaction in the business account at single platform, transferring the fund easily & instantly anytime, and streamlining the payouts for business even bulk fund transfers are some of the factors that will boost the growth of the banking-as-a-service market in the near future. Furthermore, several leading banking platform providers across Asia-Pacific have integrated API platform in the banking product to streamline the customer’s payment service and to increase the security of transaction process. Moreover, businesses can concentrate on their core skills and strategic goals by utilizing BaaS infrastructure. By contracting with specialized suppliers to handle financial activities, businesses may focus on areas that directly add to their value and allocate resources more effectively. Therefore, the increase in demand for banking-as-a-service infrastructure to improve business value is a lucrative banking-as-a-service market opportunity.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the banking-as-a-service market outlook from 2023 to 2033 to identify the prevailing banking-as-a-service market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the banking-as-a-service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global banking-as-a-service market trends, key players, market segments, application areas, and market growth strategies.

Banking-as-a-Service Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 60 billion |

| Growth Rate | CAGR of 17% |

| Forecast period | 2023 - 2033 |

| Report Pages | 271 |

| By Type |

|

| By Provider |

|

| By Component |

|

| By Region |

|

| Key Market Players | Bnkbl Ltd, Treasury Prime, MatchMove Pay Pte Ltd, Block, Inc., ClearBank Ltd, Starling Bank, Banco Bilbao Vizcaya Argentaria, S.A., Solaris SE, Green Dot Corporation, Stripe, Inc. |

Analyst Review

The leading market players, the Banking as a Service (BaaS) market represents a dynamic shift in the financial services industry, offering businesses the ability to integrate banking functionalities through API driven platforms. BaaS allows non-bank entities, such as fintech companies, retailers, and e-commerce platforms, to embed financial services such as payments, lending, account management, and digital wallets into their offerings without the need for a banking license or dedicated infrastructure. This market operates on a collaborative model where traditional banks provide the regulatory framework and backend infrastructure, while third-party platforms deliver customer oriented solutions. Increase in open banking regulations, advancements in API technology, and surge in consumer demand for seamless & embedded financial services are key drivers of the market’s rapid expansion. BaaS offers scalability, cost-efficiency, and rapid deployment of financial solutions, empowering businesses to deliver personalized customer experiences and improve financial inclusion. Key stakeholders include licensed banks, fintechs, API providers, and non-financial businesses seeking to differentiate themselves by integrating financial products. While BaaS market has significant opportunities, it also faces challenges, such as navigating regulatory complexities, ensuring data security, and competing in an increasingly crowded market. However, the sector’s growth potential remains robust, driven by accelerating digital transformation and the expanding role of embedded finance across industries such as retail, healthcare, and telecommunications. As businesses increasingly adopt BaaS to meet evolving customer needs, the market is poised to reshape the global financial landscape. BaaS fosters innovation, expands financial access, and positions itself as a cornerstone of the digital economy by enabling companies to seamlessly integrate financial services . Its ability to drive cost-effective and scalable solutions ensures strong growth potential, making it a pivotal force in modernizing financial ecosystems worldwide. For instance, in October 2024, Zenus Bank launched the successful integration of Tuum’s Accounts and Payments modules into its proprietary technology ecosystem. This significant milestone aligns with Zenus’ mission to create a global Banking-as-a-Service (BaaS) platform, enabling banks, fintechs, super apps, and businesses worldwide to embed U.S. banking services and extend them to their customers. The launch of Tuum’s Accounts and Payments modules has significantly enhanced Zenus Bank’s commercial banking capabilities, laying the foundation for its proprietary BaaS offering.

The Banking-as-a-Service Market is estimated to grow at a CAGR of 17% from 2024 to 2033.

The Banking-as-a-Service Market is projected to reach $60.0 billion by 2033.

The Banking-as-a-Service Market is expected to witness notable growth including an increase in the use of digital transformation technology in banks, streamlining financial services, and improving the fund transaction service.

The key players profiled in the report include Banco Bilbao Vizcaya Argentaria, Block Inc, Bnkbl Ltd, ClearBank Ltd, Green Dot, MatchMove Pay Pte Ltd, Solaris SE., Starling Bank, Stripe, Inc., and Treasury Prime.

The key growth strategies of Banking-as-a-Service Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...