Maternity Health Insurance Market Research, 2032

The global maternity health insurance market size was valued at $135.3 billion in 2023, and is projected to reach $269.3 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Maternity health insurance is a type of health insurance coverage designed specifically to cover expenses related to pregnancy and childbirth. It provides financial protection and helps manage the high costs associated with prenatal care, delivery, and postdelivery care for both the mother and the newborn. It covers routine check-ups, ultrasounds, lab tests, and other necessary medical expenses during pregnancy to monitor the health of the mother and the developing baby.

Key Takeaways

The maternity health insurance market Industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literature, industry releases, annual reports, and other such documents of major maternity health insurance market Industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The notable factors positively affecting the maternity health insurance market growth include a rise in the adoption of services among individuals and an increase in development strategies by public and private maternity health insurance companies which propel the market growth. However, enforcement of strong rules by banks and financial institutions for providing insurance services can hinder the market growth. Furthermore, technological advancements in insurance services offer lucrative market opportunities for the maternity health insurance market players.

The maternity health insurance market providers has been gaining significant traction over the past few years due to its increasing applications in the healthcare industry. Moreover, digital technologies such as AI, data analytics, and other technologies are increasingly transforming the life maternity health insurance industry. By implementing digital technologies, insurers enhance customer experience and efficiency in client acquisition, underwriting, claims processing, and policy administration, which is expected to boost promising market growth during the forecast period.

Demographic Insights

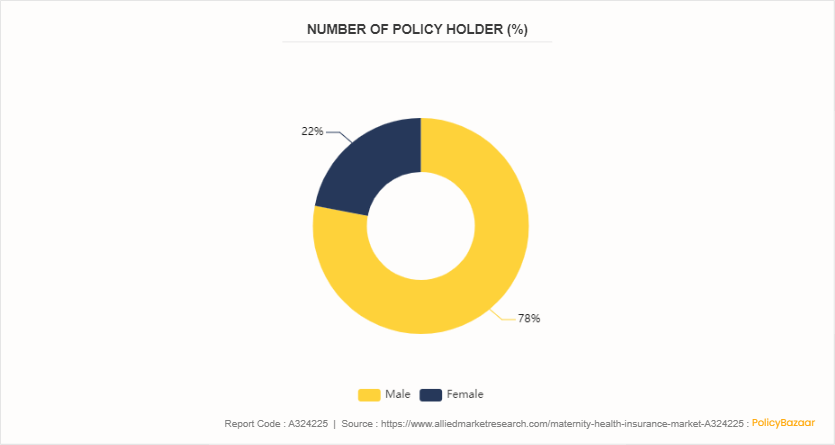

Insurance buyers in the 25- to 35-year-old age group have led the significant growth of maternity plans. According to PolicyBazaar’s data, this age group comprises 91.2% of total buyers. Male family members are taking responsibility for their child, as nearly 78% of the maternal insurance policy buyers are men. However, the data indicated a rise in women buyers in the category, as 22% of women also prefer to invest in maternity plans for themselves. These factors are further expected to fuel the growth of maternity insurance plans solutions.

FIGURE 1: Demographic Insights (%)

Market Segmentation

The maternity health insurance market share is segmented into mode, distribution channel, and region. On the basis of mode, the market is divided into online and offline. On the basis of distribution channel, the market is segregated into, direct from insurers, insurance brokers and agencies, banks, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The adoption of insurance solutions varies across different countries, influenced by factors such as technological infrastructure, industry needs, regulatory frameworks, and investment in research and development. Developed countries such as the U.S., China, Japan, and South Korea have been at the forefront of insurance solutions adoption, particularly in industries such as the healthcare industry. These countries possess advanced technological capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of maternity health insurance services across individuals. In emerging economies such as China, India, Brazil, and Russia, there is a surge in interest in maternity health insurance awareness fueled by rapid industrialization, increase in healthcare expenditures, and government initiatives to promote digitalization and innovation.

In March 2024, China initiated an extensive campaign to curb the aggressive strategies employed by its insurance sector. This government initiative primarily targeted insurers linked with private conglomerates, which used their extensive finance sector connections to embark on high-risk growth strategies.

In March 2024, the U.S. Department of the Treasury’s Federal Insurance Office (FIO) advanced its efforts to collect insurance data to better understand the impacts of climate-related financial risks on the insurance sector, by launching a first-of-its kind collaboration with state insurance regulators and the National Association of Insurance Commissioners (NAIC) .

In August 2022, the Government of Canada created the task force on flood insurance and relocation with the mandate to explore solutions for low-cost flood insurance for residents of high-risk areas and consider strategic relocation in areas at the highest risk of recurrent flooding. This interdisciplinary task force brought together experts from across the country in both the public and private sectors.

Industry Trends:

In May 2024, the Insurance Bureau of Canada (IBC) launched a new report that recommends policies that governments can adopt to help stabilize commercial insurance premiums for businesses and reduce cost pressures within the commercial insurance market.

In May 2023, the U.S. insurance industry reported an investment exposure to debt issued by the Treasury Department of $303.87 billion at year-end 2022.

In February 2024, the Government of Canada launched the Canadian Dental Care Plan (CDCP) , a new federal plan, administered with the support of Sun Life, which will help make oral health care more affordable for up to nine million Canadian residents who do not currently have access to dental maternity health insurance.

Competitive Landscape

The major players operating in the maternity health insurance market include United Healthcare, Aetna, Cigna, Kaiser Permanente, AXA S.A., Allianz SE, SBI Life Insurance, Progressive Corporation, Talanx, Zurich Ins Group and PNB MetLife.

Recent Key Strategies and Developments

In March 2024, Future Generali India Insurance launched a new product called ‘Health PowHER’ designed to address women’s healthcare needs at various stages of their lives. The product offers a range of coverage, including increased limits for Female Cancer treatments, coverage for disorders related to Puberty and Menopause, and an emphasis on Outpatient Department (OPD) services for both physical and mental well-being, with a mental illness benefit of 200%.

In February 2024, The Life Insurance Corporation of India (LIC) launched a non-participating product. The plan is designed to meet the higher education and other needs of the child.

In December 2023, Everest Insurance launched a fixed indemnity insurance product. To grow its accident and health portfolio, the Group Fixed Indemnity insurance is expected to be geared toward companies and association groups looking for non-ACA health insurance.

Key Sources Referred

Insurance Solutions Incorporated.

United Insurance Solutions

Insurance Regulatory and Development Authority of India

CSC e-Governance Services

Postal Life Insurance

Key Benefits for Stakeholders

This report provides a quantitative analysis of the maternity health insurance market forecast segments, current trends, estimations, and dynamics of the maternity health insurance market analysis from 2023 to 2032 to identify the prevailing maternity health insurance market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the maternity health insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global maternity health insurance market outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global maternity health insurance market trends, key players, market segments, application areas, and market growth strategies.

Maternity Health Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 269.3 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Mode |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | United Healthcare, Talanx, SBI Life Insurance, AXA S.A., Kaiser Permanente, Aetna, Cigna, Allianz SE, PNB MetLife, Progressive Corporation, Zurich Ins Group |

The global Maternity Health Insurance market is evolving rapidly, driven by various factors such as changing demographics, increasing healthcare costs, and advancements in technology.

Banks is the leading distribution channel of Maternity Health Insurance Market.

North America is the largest regional market for Maternity Health Insurance in 2023.

$269.3 billion is the estimated industry size of Maternity Health Insurance in 2032.

United Healthcare, Aetna, Cigna, Kaiser Permanente, AXA S.A., Allianz SE, SBI Life Insurance, Progressive Corporation, Talanx, Zurich Ins Group and PNB MetLife are the top companies to hold the market share in Maternity Health Insurance.

Loading Table Of Content...