Commercial Seaweeds Market Research, 2031

The global commercial seaweeds market size was valued at $17.9 billion in 2021, and is projected to reach $45.6 billion by 2031, growing at a CAGR of 9.8% from 2022 to 2031.

The market for commercial seaweeds is driven mainly by an increase in awareness about the benefits and medicinal uses of these seaweeds. Commercial seaweeds are used in many applications such as animal feed, human food, agriculture, and pharmaceuticals due to their thickening and gelling properties. In addition, they have various nutritive values and are therefore used in various industries.

Seaweed extract is used by farmers in agriculture because it is an effective fertilizer for crop growth. Complex liquid seaweed extracts have been shown to have innovative methods for boosting agricultural output. Farmers have noticed some additional benefits as a result of the increased understanding of seaweed used in agricultural production, including enhanced plant root systems. Seaweed also significantly contributes to the improvement of these plants' ability to withstand plant diseases and environmental challenges like cold or drought, as well as the development of their flowers, leaves, and fruit. Additionally, seaweeds enhance the microbiology, water-holding capacity, and soil structure of the soil.

Segmental Overview

The global market is analyzed on the basis of product, form, application, and region. By product, the commercial seaweeds market is divided into red, brown, and green. By form, the market is divided into flakes, powder, and liquid. By application, it is classified into food & beverage industry, cosmetics & personal care, agricultural fertilizers, animal feed additives, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

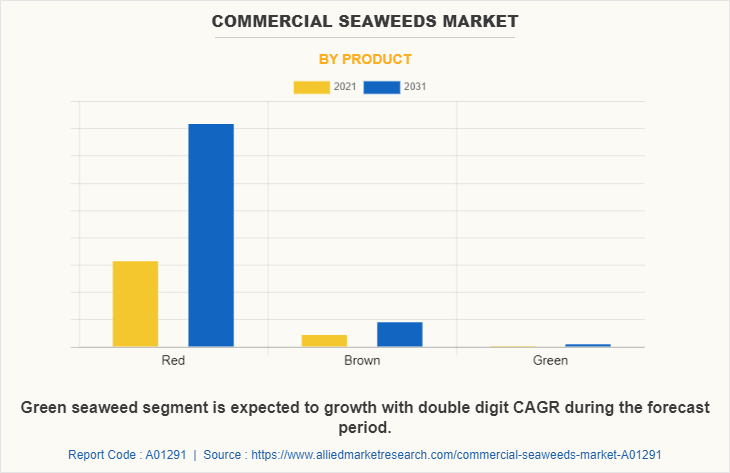

The red seaweed segment, as per product type, dominated the global commercial seaweeds market in 2021 and is anticipated to maintain its dominance throughout the commercial seaweeds market forecast period. The red color of seaweed is caused by the pigments phycoerythrin and phycocyanin, which cover up other pigments like chlorophyll, beta-carotene, and several other xanthophylls. Green seaweed is a good source of organic beta-carotene, which is helpful in avoiding some malignancies, particularly lung cancer. Green seaweed also has a variety of uses in the food business. Red seaweeds are the largest and most prevalent seaweeds, which is why this is the case. Moreover, because phycocolloids like carrageenan are present, they play a significant economic role throughout the Asia-Pacific region. As a thickening and stabilizer in food processing, carrageenan made from seaweed has many uses. Thus, it is anticipated that increased red seaweed consumption in the food industry will fuel commercial seaweeds market expansion.

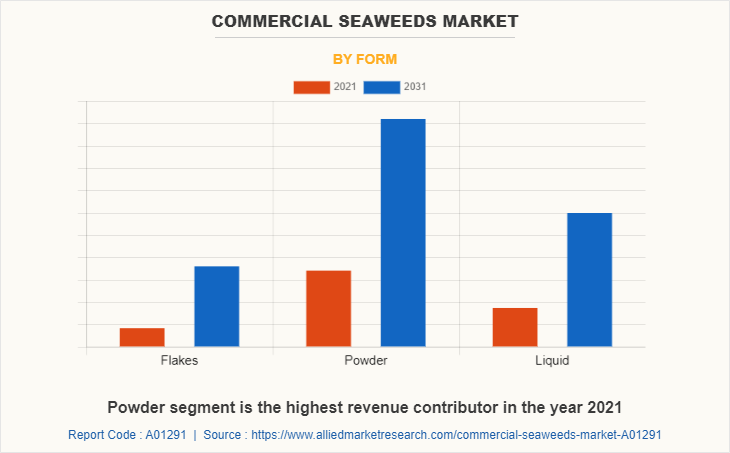

The powder segment dominates the global market. A small number of marine microalgae is added to the natural seaweed used to make seaweed powder. Seaweed polysaccharides, mannitol, amino acids, proteins, vitamins, potassium, iron, calcium, phosphorus, iodine, selenium, cobalt, and other trace elements are all abundant in natural seaweed powder.

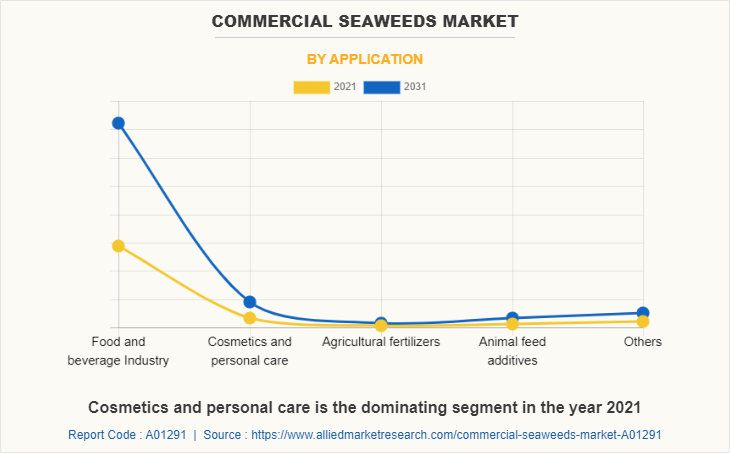

The food & beverage industry segment exhibits the fastest growth in the global market. The demand for seaweed is rising as a result of the increased use of this natural thickening and gelling agent in the manufacture of cheese, creams, sweets, and other products. The food and beverage industries are seeing a huge increase in demand for healthier ingredients. This is encouraging consumers to purchase and favor plant-based food products.

Region wise, Asia-Pacific dominated the market with the largest commercial seaweeds market share during the forecast period. The population of the Asia-Pacific region is largely concentrated in coastal regions, making it strongly related to the sea and its food supplies. Seaweed farming thus has its roots in the Asia-Pacific region. With a roughly one-fourth share of the global commercial seaweeds market in terms of value, China is the largest producer of seaweed in the world.

Market Dynamics

Due to its effectiveness in enhancing the nutritional content of food products, seaweed is in greater demand worldwide in the food sector. Prior to the migration of the Asian population into nations like the U.S., France, and Canada, macroalgae were primarily consumed in Asia; however, these days, it is often utilized as a food ingredient or added fresh. In addition, a number of hydrocolloids produced from seaweed are utilized to thicken and stabilize food products. Gels and water-soluble films are also made with it. Alginate, agar, and carrageenan are the three algal extracts that are most frequently utilized. They are employed in a wide range of food products, including ice cream, jams, fruit juices, bakery goods, and others, as gelling, stabilizing, emulsifying, and thickening agents.

The combination of hazardous waste chemicals and polymers from industrial effluents has greatly increased water contamination in recent years. Due to the numerous challenges, this causes while harvesting seaweed from ocean floors, its market price increases. According to predictions, the commercial seaweeds market expansion would be constrained by the high cost of cultivation. Due to the lack of productivity and efficiency among business units, many companies are compelled to shut down their manufacturing facilities. Farmers and manufacturers should be helped to overcome this challenge by the growing government assistance for macroalgae collection and production to fulfil the growing demand in the food business.

Due to the advantages, they provide for our health, seaweeds are presently receiving a lot of attention. Seaweeds have a high nutritional value, and their bioactive components have potent therapeutic effects that help treat a variety of medical conditions. Unique chemicals found in species of the class Phaeophyceae, phylum Rhodophyta, and Chlorophyta have a variety of qualities that could be beneficial to our health, making them valuable compounds for use in biotechnological and medicinal applications. Due to the wide variety of their metabolites, seaweeds have been used in medicine for the past three decades to treat a variety of conditions, including gallstones, stomach disorders, eczema, cancer, renal disorders, scabies, psoriasis, asthma, arteriosclerosis, heart disease, lung diseases, ulcers, etc.

The largest market is in Asia-Pacific. As the area with the largest population in the world, it has a higher market share. Additionally, the commercial seaweeds market demand is rising sharply as a result of consumers' growing consciousness. Japan and the Republic of Korea are the next-largest producers of seaweed after China. On all continents, nevertheless, seaweed is currently being grown. Seaweeds are utilized in a variety of Chinese cuisines because they contain some nutrients. Seaweeds provide cuisine with new flavors, textures, and a natural scent. As a result, the Asia-Pacific region is seeing an increase in seaweed demand.

The trend of being vegan or adopting a vegetarian diet has quickened, leading to an increase in the consumption of plant-based products. Plant-based goods are becoming more and more popular in many areas, including food and cosmetics, as people begin to believe they are healthier and safer than goods generated from animals. The development of plant-based protein substitutes currently frequently uses macroalgae as a good source of protein, which is promoting the expansion of this sector.

The rise in the use of seaweed supplements, which are rich in vitamins and minerals, is one of the main factors boosting the global market for commercial seaweeds. The commercial seaweeds market is also growing as consumers become more aware of the health advantages of seaweed, including its anti-microbial, anti-inflammatory, and anti-cancer properties. Additionally, the expanding use of seaweed in the agricultural, pharmaceutical, cosmetic, and food & beverage industries is fueling the expansion of the commercial seaweeds industry due to the product's nutritional value.

Competition Analysis

The major players analyzed for the commercial seaweeds industry are Cargill Incorporated, CJ Cheiljedang Corporation, Corbion NV, Gimme Health Foods Inc., Irish Seaweeds, J.M. Huber Corporation, Mara Seaweed, Ocean Harvest Technology Limited, Qingdao Gather Great Ocean Algae Industry Group Co., Ltd (GGOG), Roland Foods, LLC, SeaSnax, Seasol, Seaweed & Co., Singha Corporation Co. Ltd., and Taokaenoi Food & Marketing PCL. Key players operating in the market have adopted product launch, business expansion, and mergers & acquisitions as key strategies to expand their commercial seaweeds market share, increase profitability, and remain competitive in the market.

The companies in market focus on expansions, new launches and acquisitions, which drives the market. Brown commercial seaweeds find their use in food products and as raw material for the extraction of the hydrocolloid and alginate. New and innovative product offerings made by commercial seaweeds manufacturers to match different demands of the end users fuel the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current commercial seaweeds market trends, estimations, and dynamics of the commercial seaweeds market analysis from 2021 to 2031 to identify the prevailing commercial seaweeds market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial seaweeds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial seaweeds market size, trends, key players, market segments, application areas, and commercial seaweeds market growth strategies.

Commercial Seaweeds Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 45.6 billion |

| Growth Rate | CAGR of 9.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Product |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | GIMMESEAWEED, qingdao bright moon seaweed group co.,ltd., corbion, Cargill, Incorporated, seasol international pty ltd, MaraSeaweed, Ocean Harvest Technology Limited, TAOKAENOI FOOD & MARKETING PCL, SeaSnax, Roland Foods LLC, Seaweed & Co., HUBER, SINGHA CORPORATION CO., LTD., cj foods, IrishSeaweeds |

Analyst Review

The perspectives of the leading CXOs in the commercial seaweed industry are presented in this section. Demand for seaweed products has increased as a result of consumer lifestyle changes, increased health awareness, and changes in taste preferences. The demand for seaweed as food has expanded along with the influx of people from Asia-Pacific nations into North America and Europe, fueling the expansion of the commercial seaweed industry.

For instance, Nori, which is frequently used by Japanese people to wrap a sushi roll, can be purchased in American grocery shops like Whole Foods as roasted seaweed snacks. Furthermore, in North America, seaweed growers have embraced a number of innovative practices like vertical or 3D farming, which uses the water column to cultivate seaweeds. As part of the Blue Growth project of the European Union to investigate the use of seaweed in various end-use industries, European policymakers have recently pushed for the development of seaweed farming. As a result, it is projected that unexplored markets in North America and Europe will create new opportunities for seaweed producers. Examples of these applications include animal feed, fertilizer, biofuel, and wastewater treatment. However, the market for commercial seaweed is hampered by price instability and shifting weather patterns.

The global commercial seaweeds market size was valued at $17.9 billion in 2021, and is projected to reach $45.6 billion by 2031

The global Commercial Seaweeds market is projected to grow at a compound annual growth rate of 9.8% from 2022 to 2031 $45.6 billion by 2031

The major players analyzed for the commercial seaweeds industry are Cargill Incorporated, CJ Cheiljedang Corporation, Corbion NV, Gimme Health Foods Inc., Irish Seaweeds, J.M. Huber Corporation, Mara Seaweed, Ocean Harvest Technology Limited, Qingdao Gather Great Ocean Algae Industry Group Co., Ltd (GGOG), Roland Foods, LLC, SeaSnax, Seasol, Seaweed & Co., Singha Corporation Co. Ltd., and Taokaenoi Food & Marketing PCL.

Region wise, Asia-Pacific dominated the market with the largest commercial seaweeds market

Increase in awareness about the benefits and medicinal uses of seaweeds, Nutritive values of seaweeds, Surge in use of seaweed across a range of end-use industries, Changing consumer tastes and lifestyles

Loading Table Of Content...