Cream Powder Market Research, 2031

The global cream powder market was valued at $4.8 billion in 2021 and is projected to reach $8.9 billion by 2031, growing at a CAGR of 6.4% from 2022 to 2031.

The cream powder is prepared from a blend of fresh cream and milk that has been pasteurized and spray-dried to create a naturally rich cream powder. Coconut cream powder is another non-dairy solution for lactose intolerance consumers which is made from the essence of mature coconuts and has a mild coconut flavor. The cream powder is generally used in the food processing industry for preparing various products such as ice creams, chocolate, desserts, biscuits, baked food products, and others. The unique characteristics of cream powder such as good dispersibility, solubility, flavor, high-fat content, ease to handle, and storage as compared to ultra-heat treatment (UHT) milk and fresh cream, enable the cream powder to be used in various applications. The cream powder is also a cost-effective solution compared to fresh cream as it reduces refrigeration, is easy to store as well as has a high shelf life.

The COVID-19 pandemic resulted in a negative effect on the cream powder industry as the bakery, and HoReCa industries are being shut down. For instance, according to the report of the U.S. Department of Agricultural Services, the COVID-19 pandemic has negatively affected the Chinese bakery sector via disruptions to production and distribution. Both packaged and unpackaged baked goods have suffered, though the unpackaged segment has been hit harder due to shorter shelf life, consumers’ limited access to retail outlets, and increased concerns about food hygiene during the pandemic.

Cake sales have been hit especially hard by the disappearance of large celebrations during quarantine and social distancing measures. Bread has fared better than other baked goods categories because of its staple status and diverse range of potential uses, including being a breakfast option. Bread sales have also benefited from the increase in at-home meal consumption.

The cream powder is used in the various food processing industry for preparing various products such as ice creams, chocolate, desserts, biscuits, baked food products, and others. The rising bakery and dairy industries are expected to fuel the cream powder market size as cream powder is being used in both. Along with this the rising adoption of baking as a hobby by the global population is also expected to fuel the market. For instance, according to the Australian Institute of Family Studies (AIFS), 46% of the population of Australia were most likely to spend more time baking or doing art and craft. Along with this, the cream powder is a cost-effective solution in comparison to ultra-heat treatment (UHT) milk and fresh cream since it reduces the cost of refrigeration and it is easy to store as well as has a high shelf life which makes it a popular choice among consumers. Along with this, it also has various advantages such as good dispersibility, solubility, flavor, and high-fat content. Such rising preference among the global population toward cream powder owing to its unique characteristics is expected to boost the cream powder market size. Along with these factors, rising health-conscious consumers and changing consumers’ preference toward dairy alternatives coupled together is expected to boost the cream powder market demand.

The rising lactose intolerance can hamper the demand for the cream powder market. For instance, according to an article by the National Health Portal of India, 60% of the world's population is unable to process lactose in animal milk. However, the plant-based cream powder being introduced by market players may help overcome such restraint of the cream powder market since the plant-based cream powder is another non-dairy solution for lactose intolerance consumers. The plant-based cream powder being offered by various market players of the cream powder market is expected to attract the lactose intolerance population toward it which in turn is expected to boost the demand for the cream powder market. Along with this, the government laws and regulation regarding cream powder in every country is expected to restrain the market growth. For instance, according to the Ministry of Health and Family Welfare India, the fat and/or protein content of the cream may be adjusted by the addition and/ or withdrawal of milk constituents in such a way as not to alter the whey protein to casein ratio of the milk being adjusted. It shall be of uniform color and shall have a pleasant taste and flavor free from off-flavor and rancidity. It shall also be free from vegetable oil/ fat, mineral oil, added flavor, and any substance foreign to milk. Thus, the implementation of stringent regulations hampers the cream powder market growth.

The rise in the vegan population globally owing to the growing concern for the environment as well as animals is expected to create an opportunity for the growth of the cream powder market in the near future. For instance, according to a survey commissioned by the Vegan Society, the number of vegans in the UK quadrupled between 2014 and 2018. In 2019, there were 6,00,000 vegans, around 1.16% of the population. Veganism has led to a corresponding increase in the amount of money that people are willing to spend on the purchase of vegan products. Such a rise in the vegan population coupled with plant-based cream powder being offered by market players such as coconut cream powder is anticipated to boost the market prospects. Coconut cream powder, another non-dairy solution for lactose intolerance consumers made from the essence of mature coconuts and has a mild coconut flavor, is expected to create an opportunity for the growth of the cream powder industry.

The cream powder market is analyzed based on source, type, end-user, sales channel, and region. As per the source, the market is segmented into dairy-based and plant-based. According to type, the market is classified into sweet cream powder and sour cream powder. Depending on the end-user, the market is categorized into the bakery industry, dairy industry, and others. By sales channel, the market is segmented into B2C and B2B sales channels. The sweet cream powder and sour cream powder segments are further bifurcated into less than 30% fat, 30% to 60% fat, and above 60% fat. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

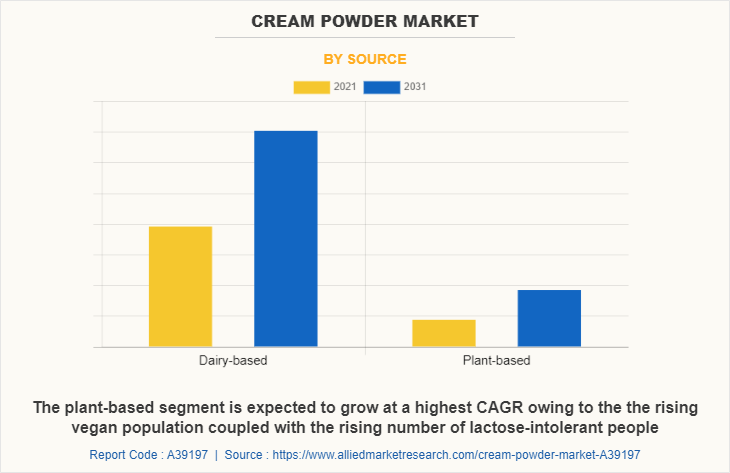

On the basis of source, the cream powder market is further bifurcated into dairy-based and plant-based. Powders constitute a major cream powder market share. The dairy-based cream powder market dominated the market in 2021 and is expected to dominate the market during the forecast period owing to its health benefits and less cost in comparison to the plant-based cream powder. The plant-based segment is expected to grow at a higher CAGR owing to the rising vegan population coupled with the rising number of lactose-intolerant people. For instance, according to the report of the National Library of Medicine, U.S. the number of consumers who are reducing their intake of food from animal origin is increasing globally due to many reasons and this involves a growing market of plant-based products to its usage in the cure of diseases and, according to an article by the National Health Portal of India, 60% of the world's population is unable to process lactose in animal milk. Such a rising vegan population and lactose intolerant people are expected to boost the growth of the cream powder market for the segment.

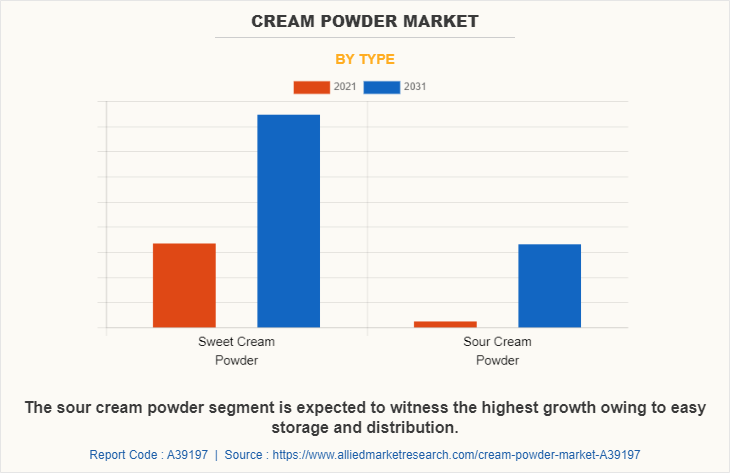

On the basis of type, the cream powder market is further bifurcated into sweet cream powder and sour cream powder. Both sweet and sour cream powder segments are further bifurcated into less than 30% fat, 30% to 60% fat, and above 60% fat. The sour cream powder segment is expected to witness the highest growth owing to the easy storage and distribution that has shifted consumers from buying sour cream to sour cream powder. The sour cream powder is also being used in the food service industry. The lack of unusual taste or odor makes the sour cream powder more appealing especially for the food service industry to incorporate into dishes. Along with this, the cost-effectiveness of sour cream powder is also expected to propel market growth.

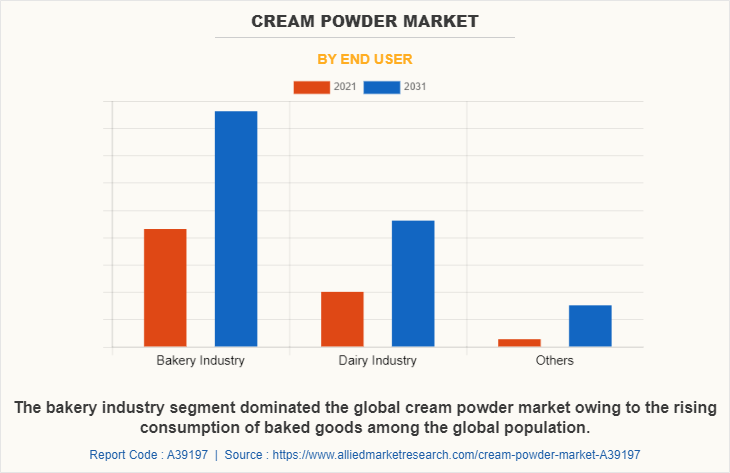

On the basis of end-user, the cream powder market is further segmented into the bakery industry, dairy industry, and others. The bakery industry segment dominated the global cream powder market and is expected to retain its dominance during the cream powder market forecast period. The bakery industry is rising at a significant rate owing to the rising consumption of baked goods among the global population. For instance, according to the report of the U.S. Department of Agriculture, China’s bakery sector has been expanding rapidly in recent years, underpinned by the country’s rising middle class, ongoing Westernization of lifestyles and diets, and increasing demand for convenient food options. Such a rise in the bakery industry is expected to propel the cream powder market for the segment.

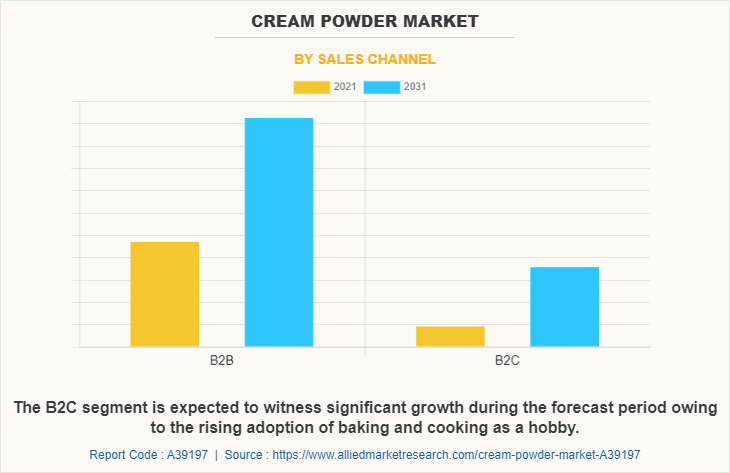

On the basis of sales channels, the cream powder market is categorized into B2B and B2C sales channels. The B2C segment is expected to witness significant growth during the forecast period owing to the rising adoption of baking and cooking as a hobby. Along with this, market players are also introducing cream powders for household consumption. For instance, Revala Ltd. is providing ice cream powder for households as a different product.

For the cream powder market analysis, on the basis of region, the market is further segmented into North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, Netherlands, and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, and the rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, and the rest of LAMEA). Europe dominated the market in 2021. Asia-Pacific is expected to witness the highest growth owing to the rising consumption of baked goods coupled with rising disposable income.

The key leading players operating in this market include The Food Source International, Inc., Arion Dairy Products B.V., Bluegrass Ingredients, Inc., Fonterra Co-operative Group Limited, Commercial Creamery Company, Shandong Tianjiao Biotechnology Co., Ltd., County Milk Products, Revala Ltd., Shenzhen Oceanpower Food Equipment Tech Co., Ltd., and WillPowder, LLC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cream powder market analysis from 2021 to 2031 to identify the prevailing cream powder market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cream powder market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cream powder market trends, key players, market segments, application areas, and market growth strategies.

Cream Powder Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 8.9 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 248 |

| By Source |

|

| By Type |

|

| By End User |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Bluegrass Ingredients, Inc., Shenzhen Oceanpower Food Equipment Tech Co., Ltd., Fonterra Co-operative Group Limited, Commercial Creamery Company, The Food Source International, Inc., Shandong Tianjiao Biotechnology Co., Ltd., Arion Dairy Products B.V., Revala Ltd., WillPowder, LLC., County Milk Products |

Analyst Review

According to the CXOs, the factors such as the increasing bakery industry and HoReCa will drive the demand for the cream powder market. However, the rising population of lactose-intolerant people can hamper the market growth during the forecast period.

CXOs further added that the rising vegan population coupled with the introduction of plant-based cream is expected to propel the demand for the cream powder market. For instance, Revala Ltd. had introduced a plant-based ice cream powder market for both industrial and household consumption.

The global cream powder market size was valued at $4,785.0 million in 2021.

The global cream powder market registered a CAGR of 6.4% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the cream powder market report is from 2022 to 2031.

The key leading players operating in this market include A The Food Source International, Inc., Arion Dairy Products B.V., Bluegrass Ingredients, Inc., Fonterra Co-operative Group Limited, Commercial Creamery Company, Shandong Tianjiao Biotechnology Co., Ltd., County Milk Products, Revala Ltd., Shenzhen Oceanpower Food Equipment Tech Co., Ltd., and WillPowder, LLC.

The cream powder market is analyzed based on source, type, end-user, sales channel, and region.

The COVID-19 pandemic resulted in a negative effect on the cream powder market as the bakery, and HoReCa industries are being shut down. For instance, according to the report of the U.S. Department of Agricultural Services, the COVID-19 pandemic has negatively affected the Chinese bakery sector via disruptions to production and distribution. Both packaged and unpackaged baked goods have suffered, though the unpackaged segment has been hit harder due to shorter shelf life, consumers’ limited access to retail outlets, and increased concerns about food hygiene during the pandemic.

Europe will dominate the cream powder market by the end of 2031.

Loading Table Of Content...